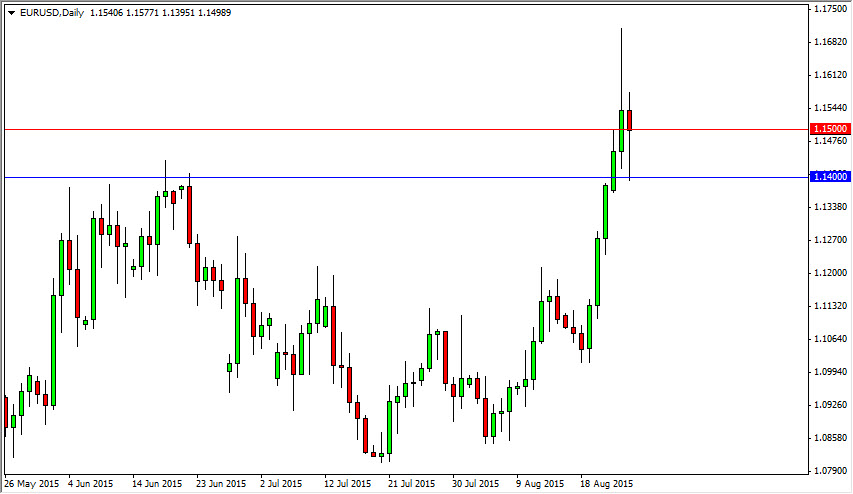

The EUR/USD pair fell significantly during the course of the session on Tuesday, but found the 1.14 level to be supportive enough to turn things back around and form a hammer. With this, I believe that this market is ready to continue going much higher, and a move above the top of the range for the Tuesday session should send this market into its next leg higher. I believe that we will eventually go as high as the 1.25 handle, based upon the larger ascending triangle. It will take a long time to get there obviously, but I do think that the trend is changing in this pair.

With the Federal Reserve now being questionable as far as interest-rate hikes are concerned, this of course sends the market higher given enough time, but I also recognize that neither one of these currencies are anywhere near an interest-rate hike. This isn't necessarily something that’s going on with the European Central Bank, it has more to do with the lack of an interest-rate hike out of America.

Buying dips

Every time this market rallies and pulls back slightly, I think you have to be looking for supportive candles in order to start going long. The Euro has been oversold for a very long time, and as a result it makes sense that we have to bounce quite significantly. I also recognize that the 1.14 level is the bottom of the area that should now serve as support, which was previously so resistive. Now that we broke above there and tested this area for support, I feel that the market should continue to go much higher from here. It is almost impossible to imagine shorting this market, at least not until we get well below the 1.13 level, something that I do not anticipate seeing anytime soon. With this, this is essentially becoming a “buy only” type of market for me.