Quantitative Forecast

Academic studies have shown that the most reliable way to determine future price movements from past price movements, is by use of momentum.

In the Forex market, a momentum study is best applied to the four major Forex currency pairs by simply checking whether the weekly close is above or below the weekly close 13 weeks ago.

If the price is higher, the statistical edge is in trading that pair long.

If the price is lower, the statistical edge is in trading that pair short.

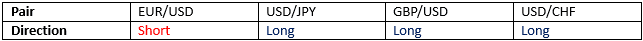

On this basis, the quantitative momentum forecast for the edge during the coming week is as follows:

Technical Forecast

The question as to whether an experienced chart-reading technical analyst can outperform a simple momentum model warrants a live experiment. Looking at the weekly charts for each of the four major pairs, I will try to determine the line of least resistance, and forecast the directional edge using my own technical analysis.

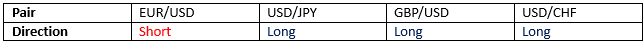

On this basis, my technical analysis forecast for the edge during the coming week is as follows:

Last week was a mixed picture, with the EUR and GBP rising, and the JPY and CHF falling, against the USD. This is not untypical for the summer months of June and July. I expect this mixed scenario might continue next week but it seems more likely the USD will strengthen across the board.

Summary

This week, the quantitative and technical forecasts agree entirely.

Next week, we will review how these forecasts performed.

Previous Forecasts

These forecasts have been running for 33 weeks.

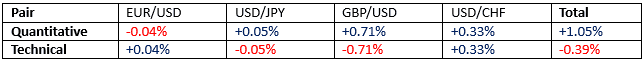

Last week, the quantitative and technical forecasts were identical. The results were as follows:

The running totals of the forecasts after 33 weeks so far are as follows:

Both forecasts have performed negatively to date, due solely to the very sharp and historically unprecedented counter-trend moves in the CHF over recent months. Excluding the USD/CHF pair, both have performed positively, but the quantitative forecast has performed very slightly better.