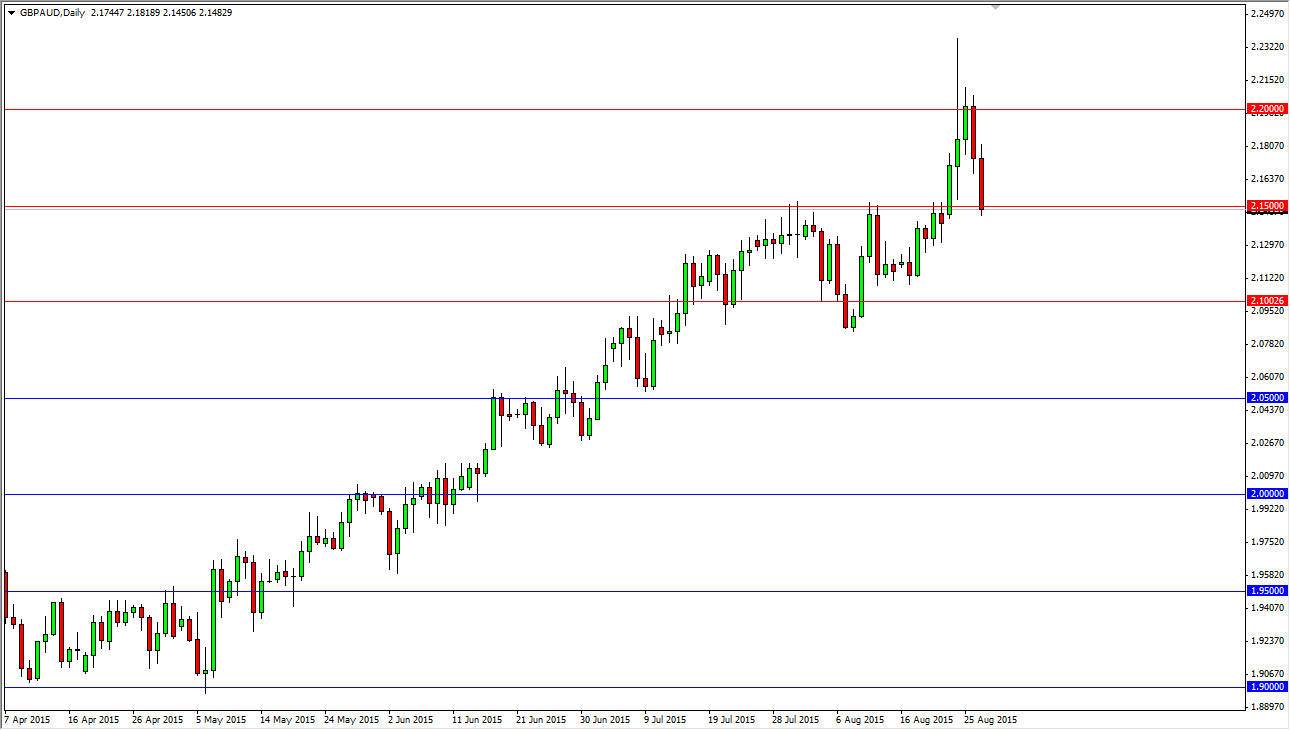

The GBP/AUD pair fell during the course of the session on Thursday, crashing into the 2.15 handle. That is an area that had been previously resistive, and it should now be supportive. On any type of supportive candle in this region, I would be a buyer as we are most certainly in an uptrend, and this was the scene of the previous breakout, meaning it should now be massively supportive. A break higher should be the beginning of a move towards the 2.20 level, which offered quite a bit of resistance in the past. That doesn’t mean that this will be an explosive move just simply that we will grind higher.

Ultimately, I have no interest whatsoever in selling this pair this moment as the Australian dollar is suffering due to commodities. Granted, the British pound got sold off rather drastically as well, but ultimately I believe that it’s only a matter time before the weakness of the commodity markets will push this market in one direction or the other.

Looking for support

I believe that we are looking for support at the moment, and it is only a matter of time before we find it. I will probably look for short-term supportive candles such as on the 4 hour chart, as I think a little bit of an overrun passes support could happen, but there is a massive cluster all the way down to the 2.10 level. If we get that, there’s no reason to think that we won’t continue to go higher based upon the very reliable uptrend that we have seen since at least the beginning of May.

Once we get above the 2.20 level, it makes sense that we just simply go to the 2.50 level given enough time. This is a fairly technical pair, and with that it makes sense that we will continue that behavior going forward.