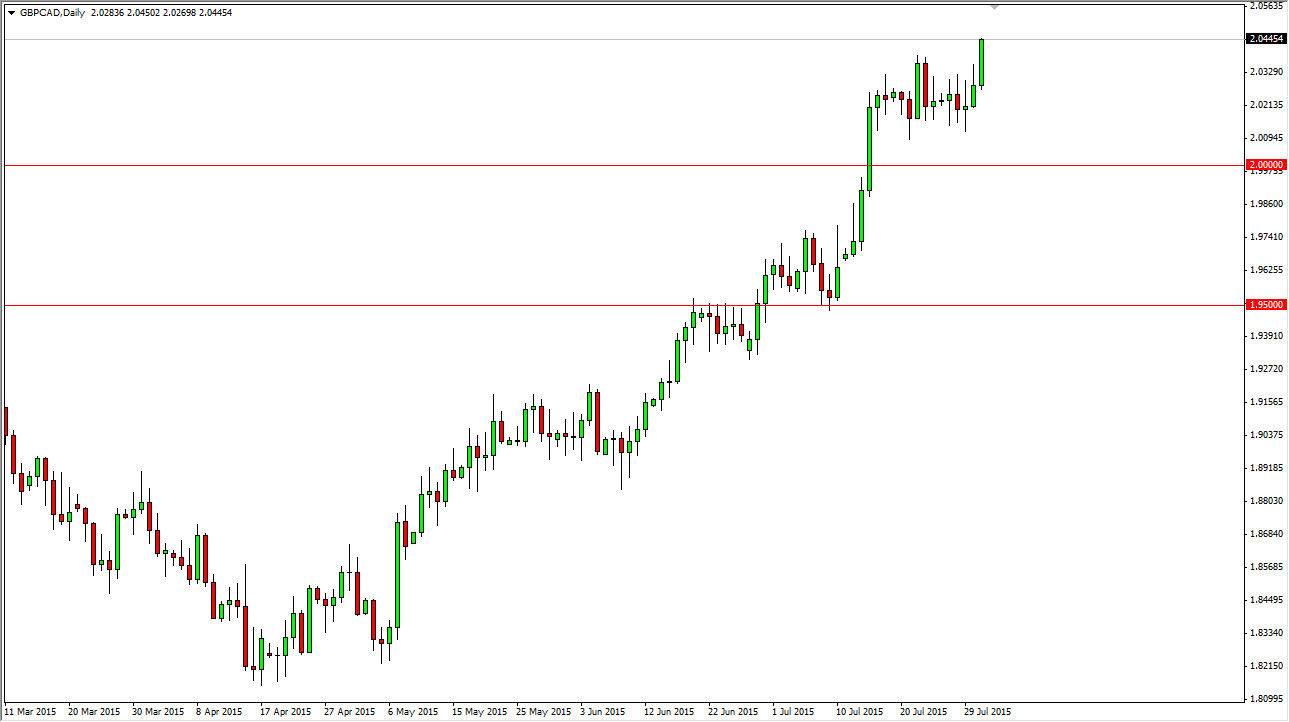

The GBP/CAD pair rose during the session on Friday, breaking out above the recent consolidation barrier. Because of this, it now appears that the market is ready to go to the 2.05 level, which of course is more than obviously a large, round, psychologically significant number for the markets to focus on. That being the case, the market looks as if it is one that can only be bought, and therefore I have no interest in selling. With that, it’s probably only a matter time before reach that area.

Pullbacks at that point in time would be a nice buying opportunity as far as I can see, as the market is so strong. On top of that, you have to keep in mind that the oil markets are soft and that of course is working against the value the Canadian dollar. The British pound has been strengthening overall, so it’s probably only a matter of time before this market continues to go even higher than the aforementioned 2.05 target.

Oil continues to soften

The oil markets falling should continue to push this market higher as the British pound doesn’t have such heavyweights upon it. That being the case, the market looks as if it should just simply continue, and that the 2.00 level being broken is the beginning of the next leg higher. I believe that is essentially the “floor” in this market, so as long as we can stay above the “double parity” level, I am only buying this pair. I think short-term pullbacks could be buying opportunities, and I will treat them as such. I have no interest in shorting as a set above, especially considering while the British pound seems to have a significant amount of support against the US dollar. At the same time, the Canadian dollar is rapidly deteriorating against its neighbor to the south. With that, I think it’s only a matter of time that this pair reaches the 2.10 level, probably by the end of the year.