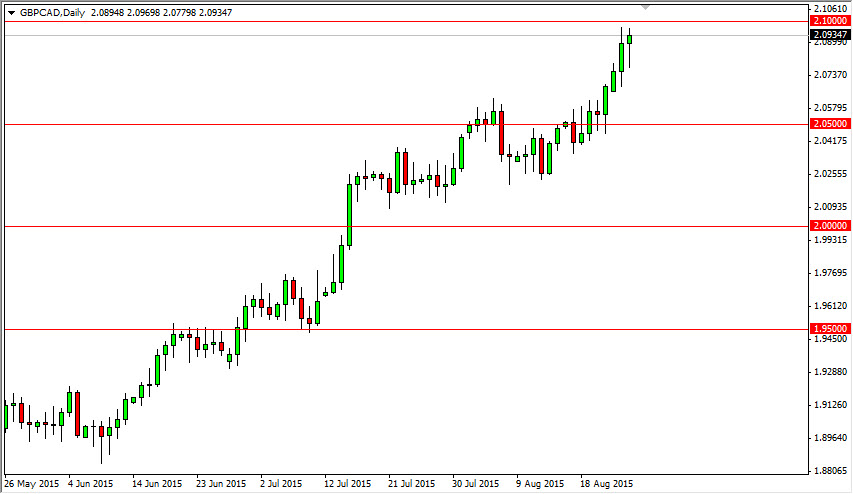

The GBP/CAD pair initially fell on Tuesday, but found enough support near the 2.08 level to turn things back around and form a hammer. This hammer sits just underneath the highs, which of course is held back by the 2.10 level. I don’t see any reason why this market doesn't break out above there though, and as a result I would be a buyer just above the 2.10 level given enough momentum. The British pound of course has been fairly strong in general, so this doesn’t exactly surprise me.

On the other hand, you have the Canadian dollar. The Canadian dollar continues to show real weakness, as the currency sold off during a day where oil markets actually gained. The shows just how little conviction there is behind the Canadian dollar, and with that I think that we will continue to see the CAD lose value overall. Pairing it up with the British pound of course signifies serious potential for a move to the upside.

Buying pullbacks

I continue to buy pullbacks in this pair, and that’s especially true once we break above the 2.10 level. Even if we pull back here, I would be willing to buy supportive candles below as I think there’s more than enough support. I think that the British pound continues to look very attractive, and it’s only a matter of time before we continue to go much higher. Ultimately, I think that we will probably aim towards the 2.15 level, but it will of course take some time to get up to that lofty level.

Going forward, the oil markets will almost have to turn things back around in order for this pair to fall apart for any significant amount of time. Oil markets are simply broken at this point in time, and therefore the Canadian dollar will be as well. I believe that this market will continue to be very trending to the upside, and very profitable for the buyers.