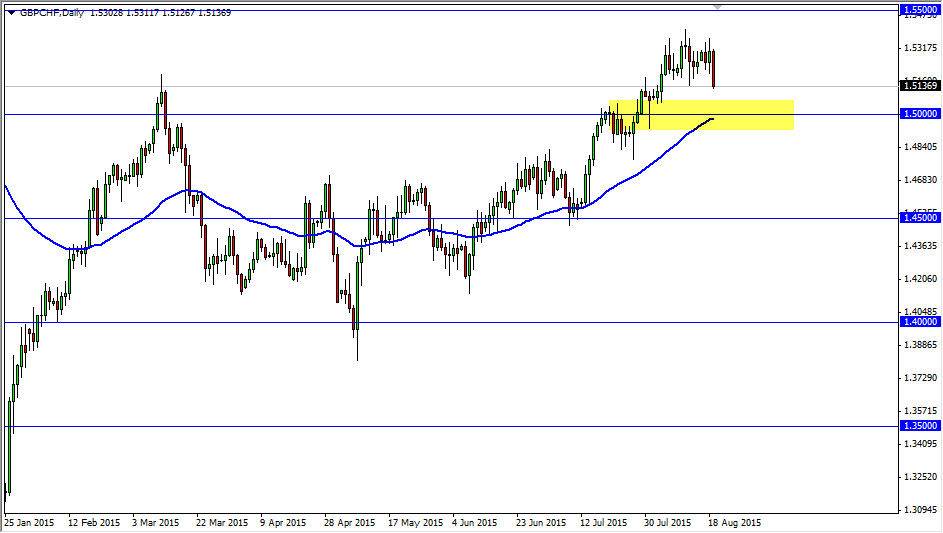

The GBP/CHF pair fell hard during the course of the session on Wednesday, crashing towards the 1.51 handle. With this, the market looks as if it is ready to continue to go little bit lower, especially considering that we closed at the very bottom of the range. With that, it normally means that we are going to see a little bit of continuation, but quite frankly I think there’s a significant amount of support just below.

The first thing that makes me think that we are going to see support is that the 1.50 level is just underneath. After all, this is a large, round, psychologically significant number. In fact, this is one of the most significant numbers that a currency pair can run into. Beyond that, the 50 day exponential moving average is just below, and as a result we should see buyers in that area as well.

British pound strength

While the Swiss franc did strengthen a bit during the day, the reality is that overall the British pound is one of the stronger currencies that we follow. Ultimately, I believe that as long as the GBP/USD pair stays somewhat stable, the British pound will continue to go higher against most other currencies, the Swiss franc of course being no different than anything else. After all, the Swiss National Bank has been working against the value the Swiss franc, and has been known to get involved in this particular pair as well as the EUR/CHF.

I think that we will find some type of supportive candle closer to the 1.50 level, and I believe that will be a nice buying opportunity. Once we get that, I would fully anticipate this market heading towards the 1.55 handle given enough time, knowing that there is going to be a bit of volatility between here and there. I have no interest whatsoever in selling this market as it has shown such resiliency and strength over the last several months.