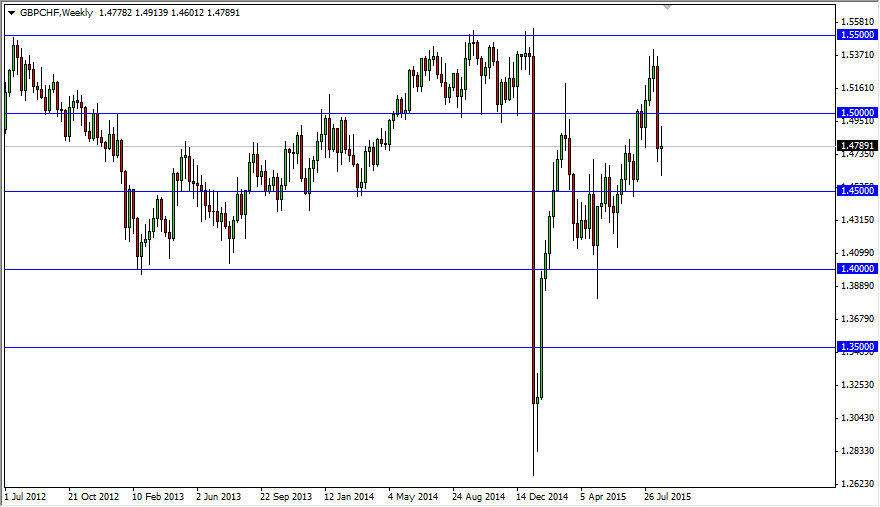

The GBP/CHF pair had a very interesting month for August, as we had initially broken much higher. However, the market fell apart as the British pound got sold off. On top of that, you have to keep in mind that the stock markets around the world sold off rather intently as well, as there were a lot of concerns coming out of China. As this is a marketplace that tends to be very sensitive to risk tolerance and risk appetite, it makes sense that we sold off. After all, most traders feel much more comfortable investing in Switzerland than picking up the British pound as it tends to be more of an investment currency. The Swiss franc is of course a “safety currency”, so this pair will fall when there’s a lot of uncertainty.

However, the last week was interesting

What we did have a negative month, the last week of August showed quite a bit of uncertainty, and I think that will probably be indicative of what we see during the month of September. I fully anticipate seeing this market bounce around between the 1.45 level on the bottom, and the 1.50 level on the top. If we can get above the 1.50 level, then we should head back towards the 1.55 handle. However, you’re going to have to watch risk appetite in general.

In other words, I think you should be watching stock markets around the world. If they continue to show signs of waking back up and going to the upside, this pair will climb. You have to keep in mind that the Swiss National Bank is working against the value of the Swiss franc as well, so it’s only a matter time before we rise every time we fall. I think that playing the range is probably the safest thing to do first, but I have to admit that there’s probably more of a bias to break out to the upside than the down.