The GBP/CHF pair is one of my favorite pairs. This is a pair that has a reasonable spread, but it has quite a bit of volatility. When you get the trade right in this pair, you can make a lot of money in a very short amount of time. However, this is the time year where trades tend to be a little bit smaller in duration and length, so patience is required.

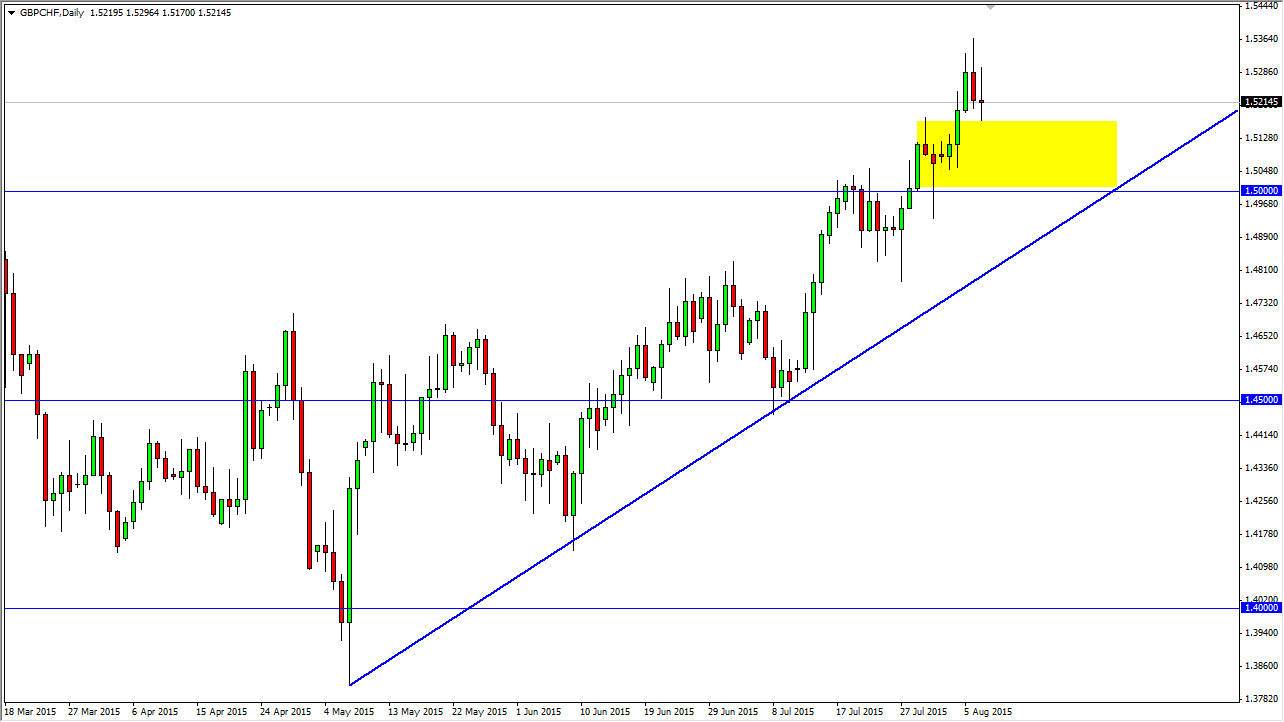

Looking at the chart, you can see that we formed a shooting star on both Thursday and Friday, and that of course is a very bearish sign. However, you cannot look at these things in a vacuum. I mean by this is that just recently we had broken above the 1.50 level and formed a massive hammer. We also have an uptrend line as you can see on the chart, and of course the psychological significance of 1.50 itself.

Looking for support

Because of this, I think that this pair is going to be looking for support. I think it will find it somewhere in the yellow rectangle that I have on the chart, roughly between 1.51 and 1.50, the site of the recent breakout. Because of this, I think if you are patient enough and simply willing to let the “market come back to you”, there’s money to be had.

f we keep in mind that the British pound is doing fairly well against the US dollar, which of course is the benchmark of any currency. At the same time, keep in mind that the Swiss National Bank has been working against the value the Swiss franc directly. They haven’t even worked in this particular pair from time to time, although it is more or less an afterthought when compared to the EUR/CHF pair. Nonetheless, there is a bit of a “knock on effect” because of that, so I would anticipate that there will be buyers below. With this, the closer we get to the 1.50 level, the more interested I am in buying.