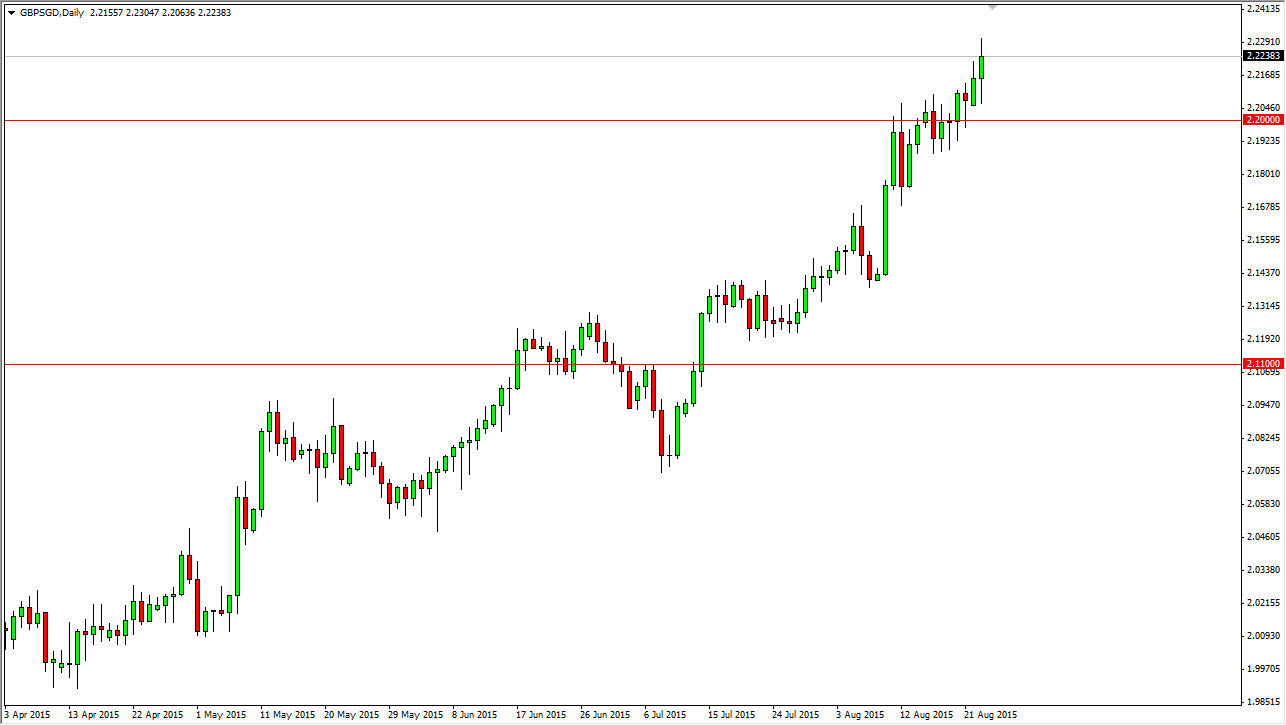

The GBP/SGD pair initially fell during the session on Monday, but found enough support just above the 2.2000 round number to continue to go higher. With this, the market looks as if it is ready to grind itself higher again, heading to the 2.2500 level now. It makes sense to me, the British pound has been strong, and the Singapore dollar has the misfortune of being an Asian currency used to finance the construction projects in various areas.

The 2.2000 level below should be supportive going forward, and with this I think that any pull back at this point in time should offer “value” in the relatively strong Pound. The pair will continue to go higher as long as we are concerned about Asian economies. (I’m looking at you, China.) This makes a lot of sense in my opinion, as the markets will always favor the more “developed” economies over Asian ones in times of fear.

Buying pullbacks

I am probably going to continue to buy pullbacks, as the trend has been so strong for months. This pair looks like it is in a steady and strong uptrend, and as a result I am much more confident in this pair going up and in a steady manner than most other pairs. The pair isn’t one of the more popular ones, but as you can see on the chart, it tends to move in a very steady manner. With this, I think we can add to our positions to the upside every time we pull back. In fact, I think we should continue to see buying pressure again and again as Asian seems to be struggling on the whole. True, Singapore itself isn’t in bad shape, but the banks in that country certainly will be feeling the heat. I think we will see this pair continue the longer-term move, and have no interest in selling at the moment.