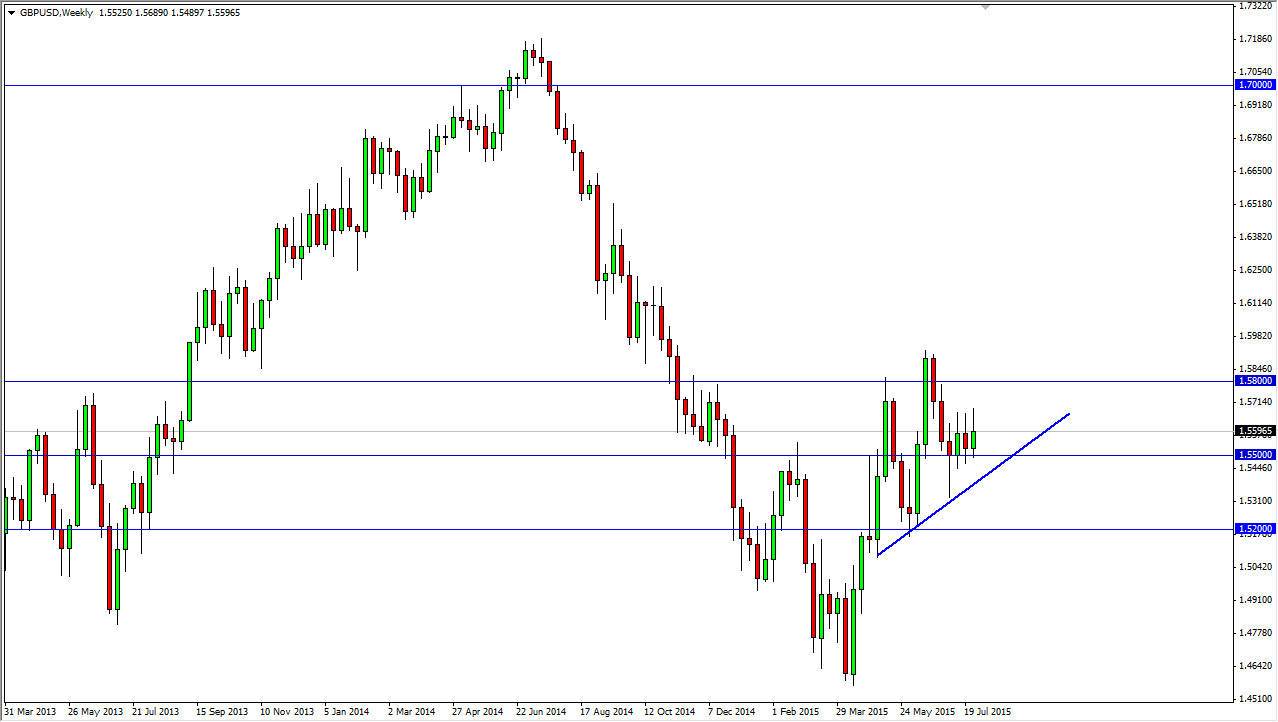

The GBP/USD pair initially tried to rally during the course of the last week of July, but just as it had during most of July, it could not hang onto the gains and it ended up forming a bit of a shooting star. Because of this, it looks like the market may struggle to go anywhere in the short-term, and I believe that the uptrend line on the chart is probably going to be the catalyst to push this thing higher. After all, August is a horrible month for trading sometimes, and this is nothing on the horizon right now to get me excited for the next couple of weeks. I believe that this pair is going to be one that go sideways overall, but that doesn’t mean that there will be trading opportunities, just that you will have to look to shorter-term charts.

Looking at this chart, I do think that we will eventually break out to the upside but we are certainly having to work against pretty significant barriers above. I believe that the 1.55 level will eventually be broken but it will probably be sometime in September. After all, that’s what most of the liquidity returns that the market.

Short-term trades in the meantime

I believe that only short-term trades can be used in the meantime, with the 1.57 level being a significant barrier to the upside. I also recognize that the 1.55 level will be supportive, but I think that the uptrend line is much more important, so really as long as we stay above there are willing to buy this pair. I think that this pair will continue to struggle in general to find some type of direction over the course of the next couple weeks, so I am actually basing most of my trades off of the one hour chart, but keeping these levels in mind.