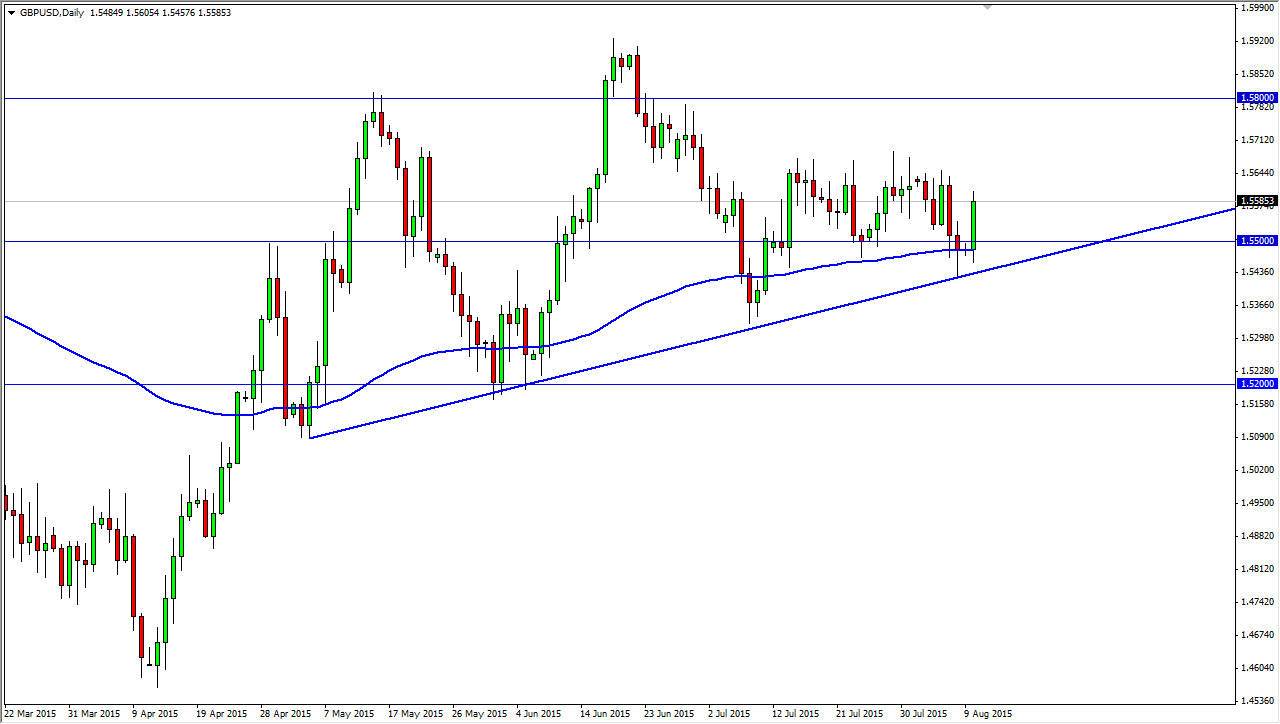

The GBP/USD pair initially tried to fall during the course of the day on Monday, but as you can see the uptrend line has held true. Because of this, I believe that this market is well supported below. On this chart, I have the 100 day exponential moving average as well, and that of course is a very positive sign. The 100 day exponential moving average is one of the favorites of long-term traders, so at this point in time I believe that larger traders are starting to come into this market and pick up the British pound based upon “value.”

The 1.57 level above is significant resistance, as we’ve seen this market several times test this area but failed. Ultimately though, I believe that sooner or later we will finally break above that area. It makes sense though, not moving that much at the moment, as the markets have very little in the way of volume at the moment.

Summertime blues

The summertime tends to be low liquidity, and as a result we don’t get much in the way of movement. I think that’s essentially where we are right now, simply waiting for the volume to return. I think it’s only a matter time before it does, but we are probably going to see at least a couple of weeks of sideways action. Generally though, we do see quite a bit of motion towards the beginning of September.

The British pound has of course held its own against the US dollar in general, while most other currencies have not. Because of this, it seems like the British pound will probably take off to the upside once we do get that volatility and volume in the market. I believe that the uptrend should continue, and as a result I am not looking for selling opportunities at the moment. With this, I am looking to buy pullbacks, as I believe that the 1.57 level will probably cause a bit of bearish pressure later in the day. I will look to short-term charts in order to place these trades, as I do not believe that there is enough room for daily charts to be used right now.