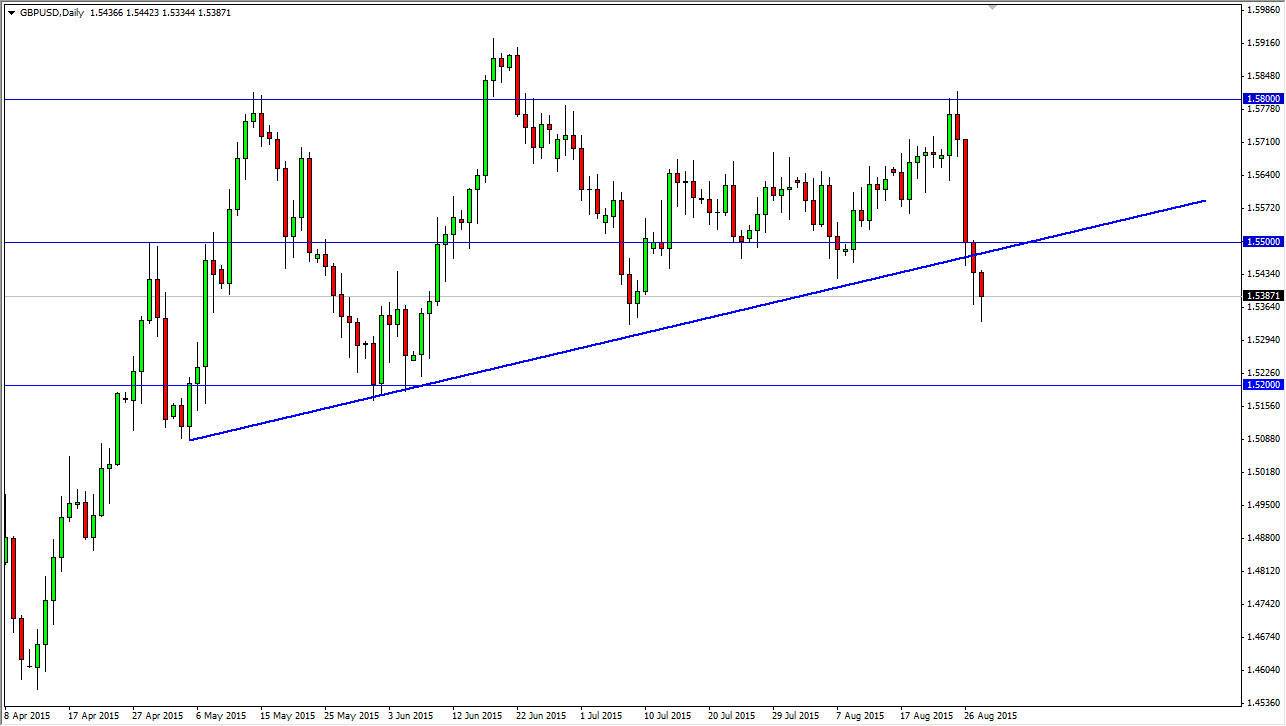

During the session on Friday, the GBP/USD pair fell significantly. However, we did find a bit of support at the 1.53 level, and ended up forming a hammer for the second day in a row. Because of this, I think that a rally is likely but I also have to pay attention to the uptrend line that was recently broken. Because of this, it’s very likely that any rally will be short-lived. I think at this point in time this will be a simple retest of the bottom of the trend line, and that somewhere near the 1.55 level we should have sellers come back into this marketplace.

It is also possible that we could just simply break down below the bottom of a hammer, and that of course is a selling opportunity as well. This market should then head down to the 1.52 level, which has been supportive in the past. I don’t know if we can break down below there, but it certainly seems as if the dynamic of this together pair is changing now that more liquidity is coming to the marketplace at the end of summer.

1.55 is the most important level in this particular currency pair

It is not until we close above the 1.55 level on a significantly strong daily candle that I would consider buying. In the meantime, I have to assume that the uptrend has been broken, at least temporarily. The British pound of course has been very strong over the last several months, but this change in attitude could be more of a return to US strength than anything else. Initially, I thought that perhaps it was based upon fear but the US stock markets appear to be strengthening overall, and as a result I think this could just simply be a result of money flowing into the United States and out of various parts of the world right now. Again, I think the 1.55 level will be massively important.