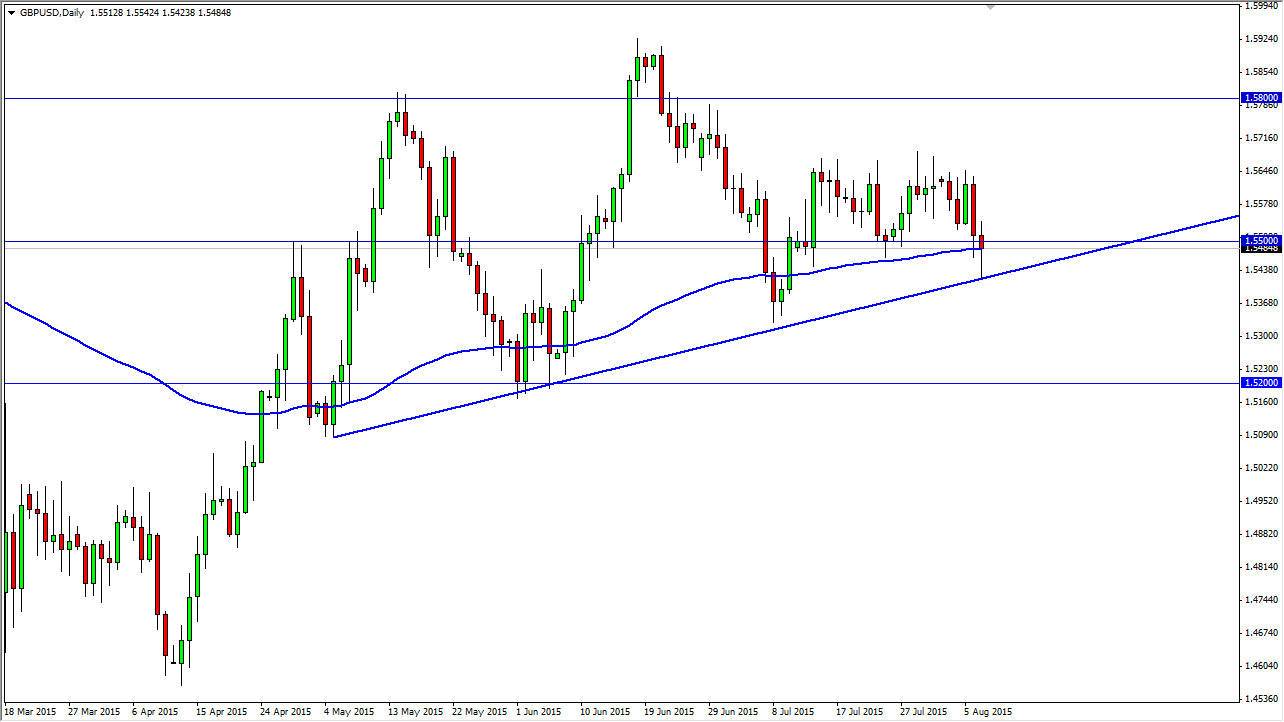

During the session on Friday, we initially fell in the GBP/USD marketplace, in reaction to the Nonfarm Payroll Numbers. However, as you can see I have an uptrend line drawn on the chart, and we touched that line and bounced directly from that level. With this, we ended up forming a nice-looking hammer which of course is a sign of strength.

I also like this hammer because it sits directly at the 100 day exponential moving average, and I believe that if we can break the top of the hammer we will probably continue the consolidation that we’ve seen recently. That means that the market should then head to the 1.57 level. Yet to keep in mind that this is the middle the summer, and as a result a lot of big money is simply away of vacation and not worried about what’s going on in the currency markets.

Because of this, I feel that if you are looking for some type of explosive move in one direction or the other, you are going to be sorely disappointed. I think that it’s probably not to be until the first week of September that we see any real strength behind any move, but at this point in time I do recognize that there are opportunities.

Upward grind

I believe that the market will continue to grind upwards given enough time, and that short-term pullbacks will continue to be buying opportunities. After all, the British pound has held its own against the US dollar in relation to how other currencies have behaved, and of course the 100 day exponential moving average is of course one that is followed by a lot of long-term traders.

While I do not expect an explosive move higher, I do recognize that we will probably try to get to the 1.60 level given enough time. This probably won’t be for several weeks, but that is my target for the short-term. Ultimately, I think this pair goes much higher. I have no interest in selling.