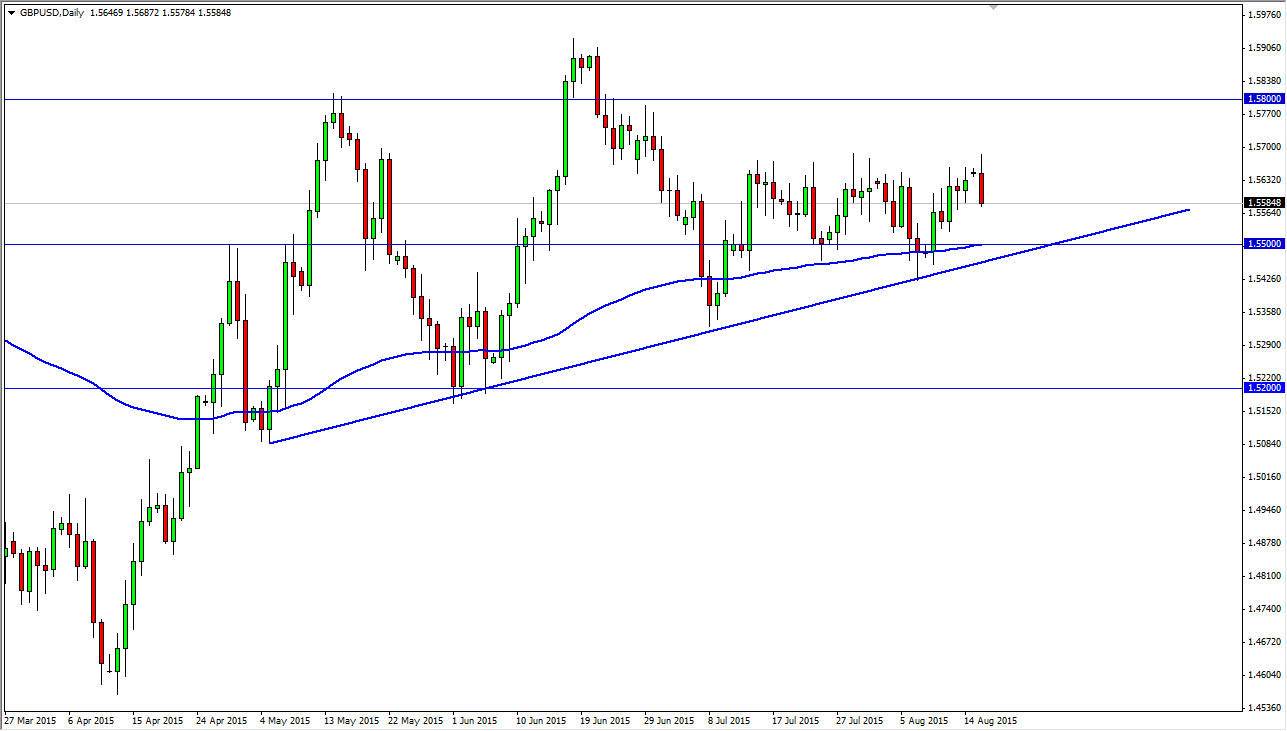

The GBP/USD pair initially tried to rally during the course of the day on Monday, but found the area near the 1.57 level to be a bit too resistive to continue going forward. With this, I feel that it’s only a matter of time before we drop back down towards the 1.55 handle. After all, that is a large, round, psychologically significant number which of course normally means that there are traders interested in this general region.

I have also said that the 100 day exponential moving average of course attract a lot of interest as well, especially from longer-term traders. After all, it is one of the standard long-term moving averages that people use from the old stock market analysis. With that being said, it kind of serves as a “de facto” in medium-term average as both the 50 and the 200 day exponential moving averages are often lumped in as well.

I also believe that the uptrend line just below is very supportive as well, and it is not lost on me that it is currently close to the 1.55 handle. I think there is just too much in the way of support below to think that this market is going to be able to fall with any significance at this point in time. Yes, there are CPI numbers coming out of the United Kingdom today, but quite frankly I think that any pullback at this point in time is probably going to be short-term at best as we continue to consolidate in general.

Summertime

Anytime supportive candle near the 1.55 level is reason enough for me to start buying. But I also recognize that it is the summertime so to look for any significant move at this point in time is probably going to be almost impossible to imagine. I think that once we get closer to the beginning of September, we could get significant liquidity to finally push this pair higher. I still believe that we could very well reach the 1.60 handle given enough time.