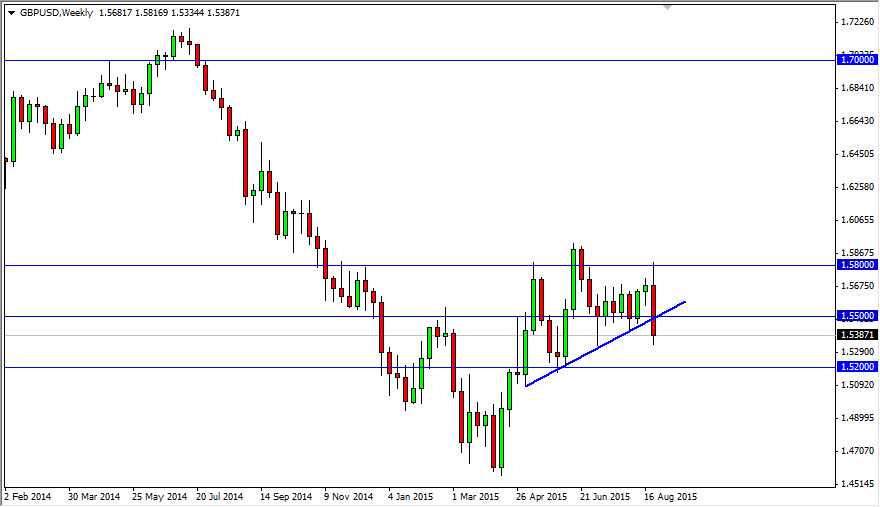

The GBP/USD pair reached all the way to the 1.58 level during the month of August, but turned back around and sold off rather drastically towards the end of the very same month. With that, I cannot help but notice that we broke down below what seemed to be a fairly reliable uptrend line. Because of this, I think that the British pound will sell off a bit during the month of September. However, I recognize the 1.52 level below is rather supportive, so I don’t necessarily think this is going to be a massive meltdown.

At the very end of the last full week of August, the market started to try to rally. We had just broken down below that uptrend line, so I think this means that the market is going to try to see if we find resistance at the 1.55 level. If we do, I think that’s when the selling pressure really starts to pick up. It wouldn’t surprise me at all if we bounce off of the 1.52 level though, and back towards the 1.55 level. That would essentially turned the last couple of months into a major consolidation area.

Volatility

Regardless what happens, I think this will be a fairly volatile pair over the next couple of weeks. I would keep my position small, and of course be willing to take profits rather quickly. That being said, I think we can break above the 1.55 level on a daily close, that negates everything as far as the negativity is concerned and would more than likely send this pair looking for the 1.58 level yet again. With that being said, I believe that not only does this pair shown the potential for a lot of volatility in the Forex markets, but most other pairs do as well. The cable pair tends to be a fairly quick mover over the longer term anyway, so that wouldn’t be much of a surprise would it?