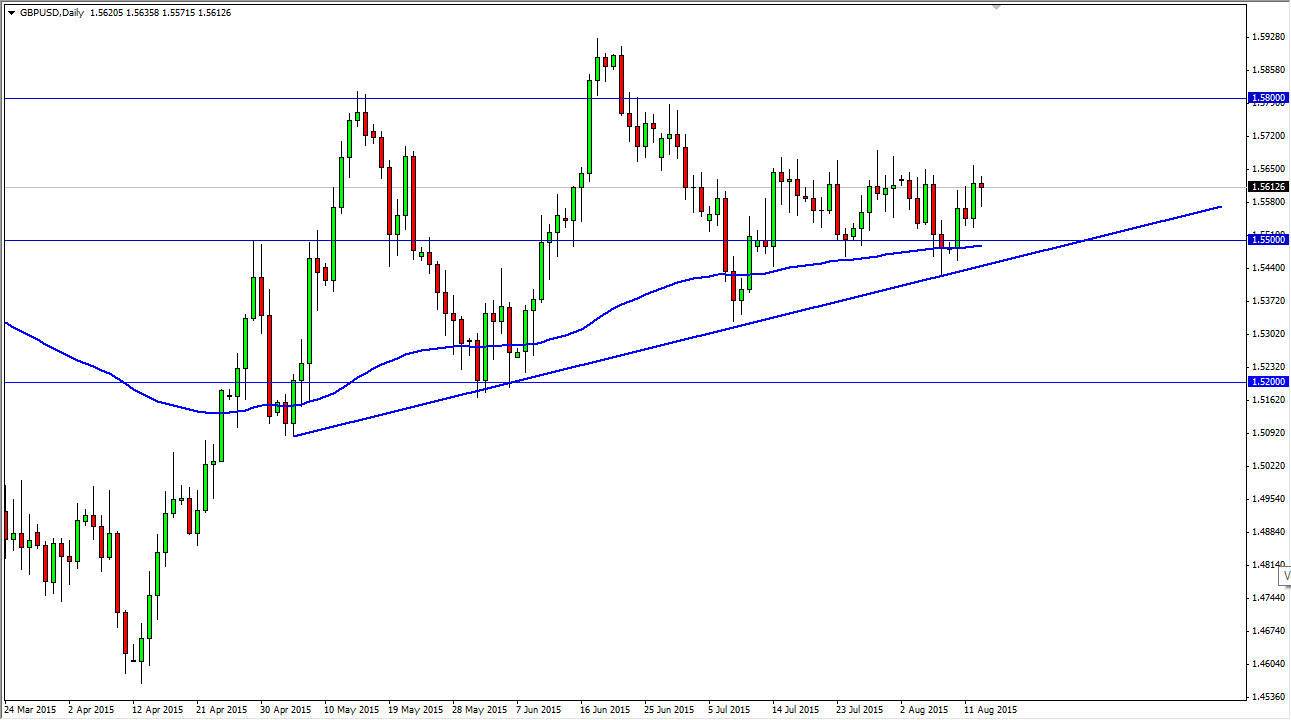

The GBP/USD pair initially fell during the course of the day on Thursday, but found enough support at the 1.5550 level to turn things back around and form a hammer. The hammer of course is a very bullish sign but I think that we have a significant amount of resistance above as well. So when I look at a chart like this, I recognize that the market is trying to build up enough momentum to break out to the upside. Because of this, I have no interest in selling this market and any pullback at this point in time I have to look at as “value” in the British pound. After all, the British pound has held its own against the US dollar and shown quite a bit of strength in general.

Buying pullbacks

I will continue to buy pullbacks in this marketplace, because there are so many different opportunities to see signs of support here. The 1.55 level is of course a large, round, psychologically significant number that has shown support. On top of that, we have the 100 day exponential moving average below, and that of course is sitting right at about the 1.55 handle. With this, the uptrend line is just below there as well, so there are far too many things below to make the think that this market is going to suddenly be able to break down.

Granted, the US dollar is one of the strongest currencies in the world right now, but the truth of the matter is that the British pound is the one outlier. I think that we will then head to the 1.58 level if we get above the 1.57 level, and with that the buyers should flood into the market. Eventually we get above the 1.58 level, and then head to the 1.60 level. That is my longer-term target, and as a result I will be aiming for it but I recognize that there will be a lot of volatility between here and there.