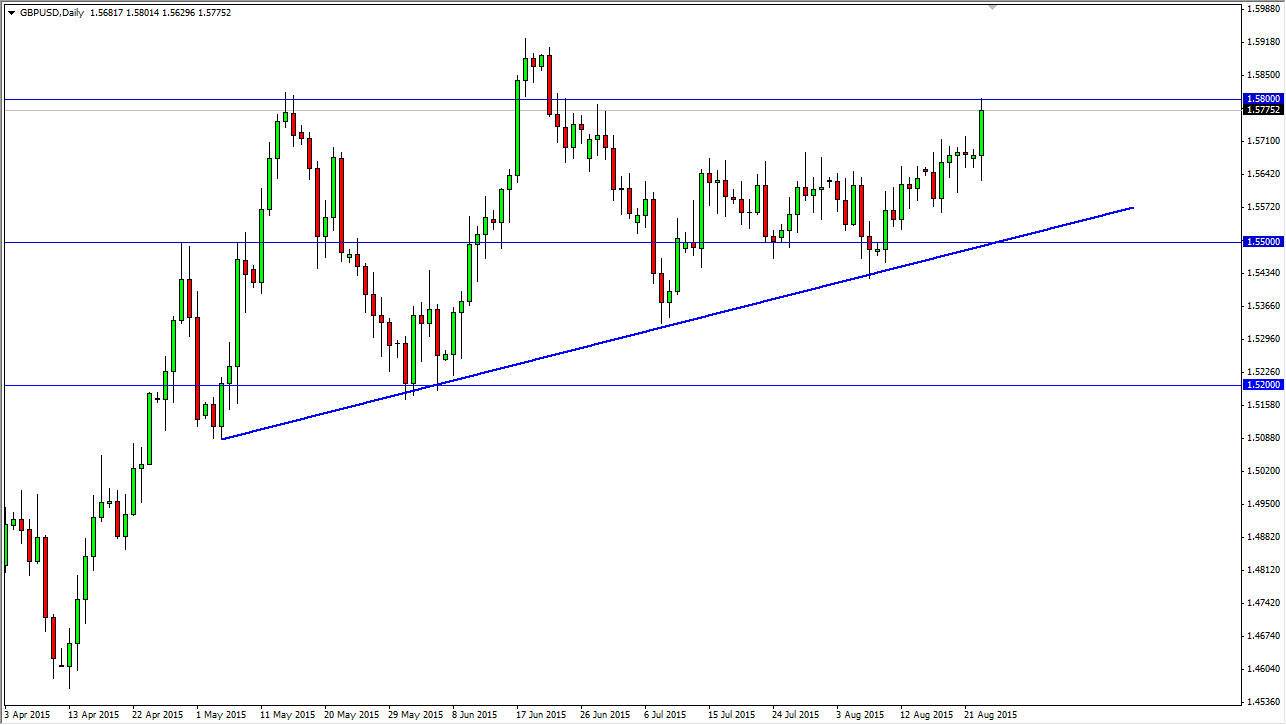

The GBP/USD pair initially fell during the session on Monday, but found enough support to turn things back around to slam into the 1.58 level resistance barrier. The pair continues to look bullish, and if we can get above this level, we should see this pair go much higher. During the session, we saw a lot of US dollar selling, predicated upon the idea of the Federal Reserve not being able to raise rates later this year. The markets have assumed the rate hike for so long now, there is a lot of unwinding to be done at this point if it turns out to be untrue.

The 1.58 level has been important in the past, and as a result we think that a break above it should be a strong sign for the bulls. The markets should continue to sell the Dollar at this point, simply because the EUR/USD broke higher and above the “line in the sand” as far as I can see, as we are above the 1.15 level in that market. It should certainly continue to favor Dollar selling, and it won’t be any different in this pair.

The Pound has been strong

The British pound has been strong against most other currencies in general, but has at least “held its own” against the Dollar. With this in mind, I think that we are destined to break out given enough time. The 1.60 level above should be resistance, but in the end it will only be a blip on the radar. This markets will certainly be volatile, so keep this in mind. Anytime there is a massive sell off in the equities markets, there is a bit of a “ripple effect” in the currency markets. With this, it is only a matter of time before we see it in this pair as well. I have no interest whatsoever in selling this pair.