Gold prices advanced to their highest levels since July 20 as the dollar tumbled after a reading on consumer-price inflation missed expectations and minutes from the U.S. Federal Reserve's July 28-29 policy meeting dampened expectations for a rate hike in September. "Some members continued to see downside risks to inflation from the possibility of further dollar appreciation and declines in commodity prices...The Committee agreed to continue to monitor inflation developments closely, with almost all members indicating that they would need to see more evidence that economic growth was sufficiently strong and labor markets conditions had firmed enough for them to feel reasonably confident that inflation would return to the Committee's longer-run objective over the medium term" the minutes said.

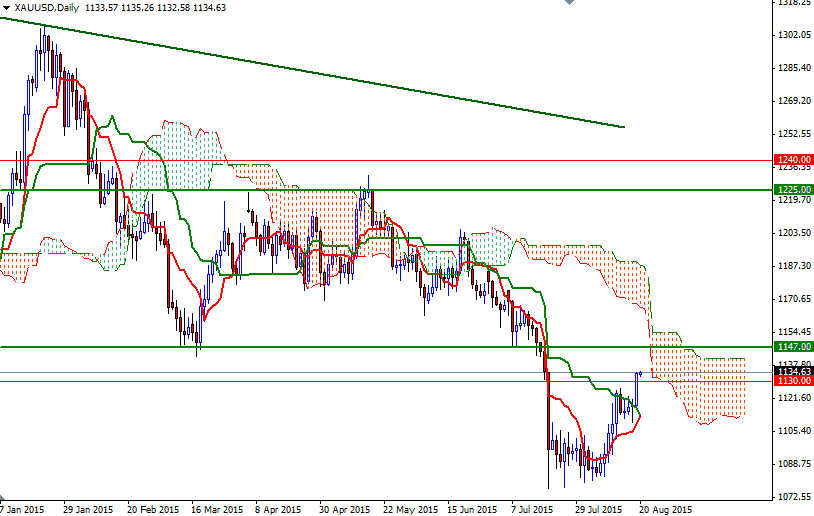

Apparently, the idea that the lack of inflation will keep the Fed from rushing to normalize policy is likely to provide a lift to gold in the near-term. The XAU/USD pair advanced nearly 5.5% since the market found support at 1076 and from an intra-day perspective, we seem to have more pressure from the bulls than bears. As I have been telling lately, the short-term outlook suggests that there is a possibility of prices marching towards the daily Ichimoku cloud. It seems as if the market will continue its bullish tendencies (as long as prices trade beyond the could on the 4-hour time frame) and test the resistance at the 1147 level which had caused prices to reverse in the past.

The outcome of the test of 1147 is probably going to reveal what will happen next. Technically, since the daily cloud resides in the same area, it wouldn't be so surprising to encounter a heavy resistance. If the bears take over and prices start to retreat, look for support at 1130, 1125.50 and 1116.80. There are a bunch of supports in the 1116.80 - 1109 region where the daily Tenkan-sen (nine-period moving average, red line) and Kijun-sen (twenty six-period moving average, green line) lines intersect. The bears will have to capture this strategic camp in order to gain more momentum and test 1103.