Gold prices ended nearly flat on Tuesday as some investors moved to the sidelines ahead of Friday's monthly jobs report. The XAU/USD pair traded as high as $1097.66 an ounce but retreated back to $1086 level after Atlanta Fed President Dennis Lockhart, a voter this year on the Federal Open Market Committee, commented on the outlook for interest rates. He said that the economy was ready for the first rake hike in nine years and it would take a significant deterioration in the economic picture for him to be disinclined to move ahead.

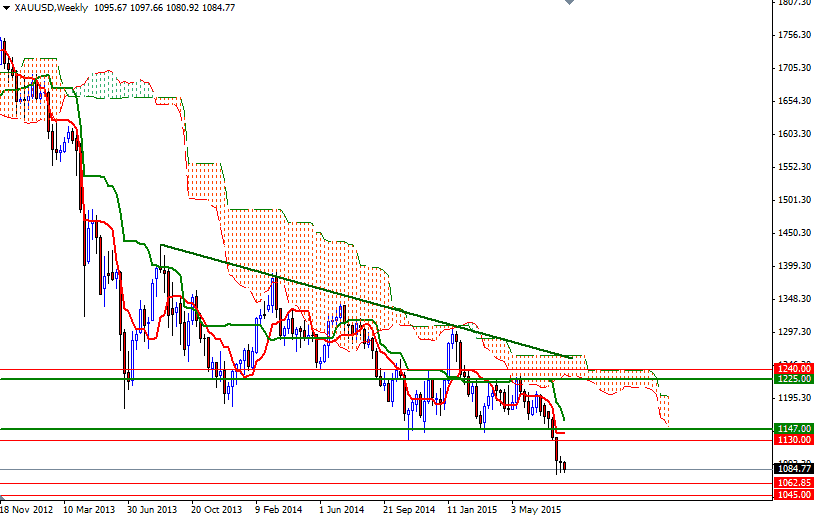

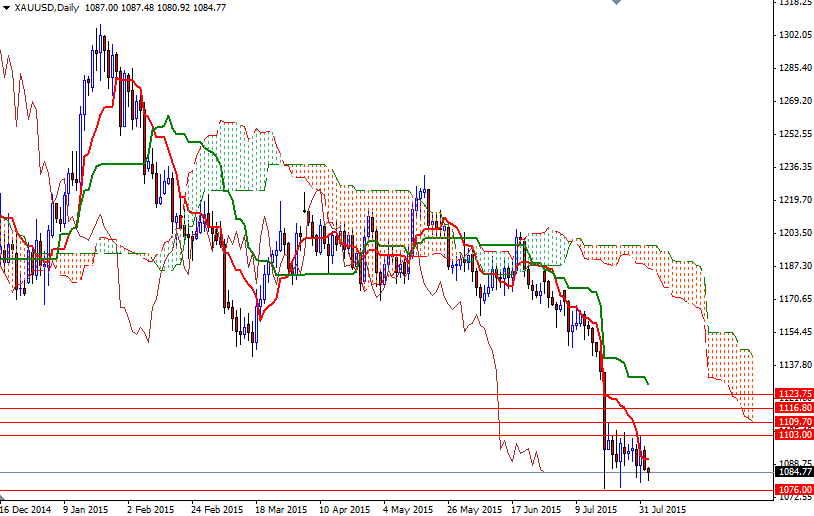

The potential for increasing borrowing costs this year also pressured U.S. stocks, but the decline in the stock markets failed to offset pressure on gold from the rising dollar. The price of the precious metal has been sliding for weeks since the market had encountered a significant amount of resistance around the 1225 levels back in mid-May. The long-term charts remain bearish, with the market trading below the weekly and daily Ichimoku clouds, plus we have negatively aligned Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-period moving average, green line) lines.

This picture suggests that the market will struggle to hold onto gains, unless prices climb back above the 1147/30 area (where XAU/USD found support and reversed its course in the past) at least. In the meantime, however, I will be keeping an eye on the recent consolidation box that trapped us between roughly the 1109 and 1076 levels. The bulls will need to take out the resistance at 1103 if they want to have a chance to make an assault on the 1109.70 level. To the downside, support can be seen in the 1079 - 1076 area. If this support is broken, then we are likely to proceed to 1071. Dropping through 1071 would open a path to 1062.85.