Gold prices ended Tuesday's session nearly unchanged after shuffling between gains and losses, as investors took a cautious stance ahead of the release of minutes of the Federal Reserve's latest policy meeting and inflation data. Yesterday's U.S. data was mixed with building permits falling sharply in July but construction of new homes rising to a near eight-year high.

While an upside surprise in consumer prices could bolster views that the Federal Reserve will raise interest rates in September, a dismal print (possibly due to the renewed decline in oil prices) would depress inflation expectations. In the meantime, keep an eye on the major stock markets because strong signs of weakness in these markets might give a temporary boost to the precious metal.

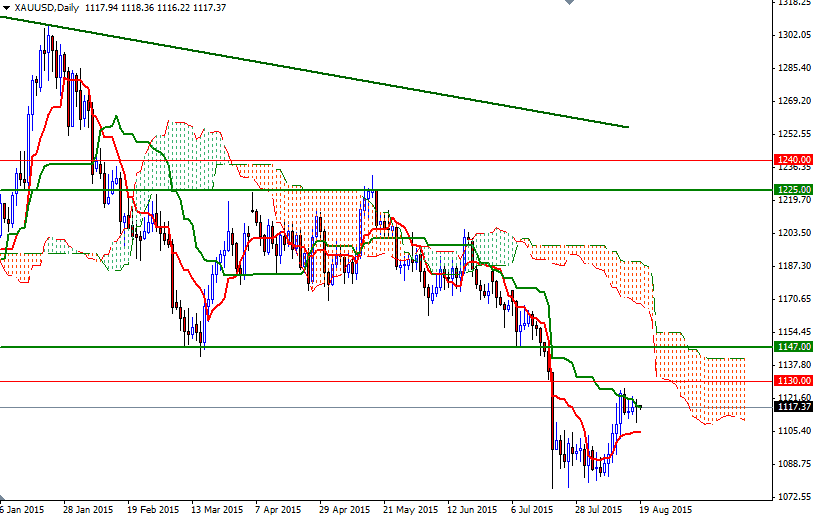

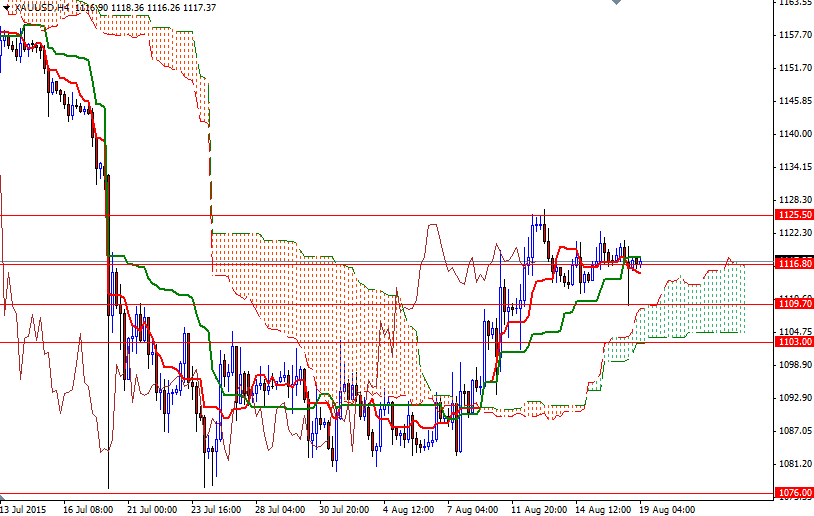

Speaking strictly based on the carts, I think the key levels to watch will be 1109.70 and 1125.50. Despite the negative long-term outlook, it is possible to see the XAU/USD pair challenging the 1147/30 resistance zone if the 1125.50 is cleared. A break below 1109.70 would indicate that the market will be visiting the critical support at the 1103 level where the bottom of the Ichimoku cloud sits on the 4-hour time frame. Once the market shatters this support, I think we are likely to proceed to 1096/4.