Gold prices ended Friday's session up $4.42, to settle at $1093.95 an ounce as weaker than estimated employment growth in the U.S. pushed down stocks and sent some investors toward safety plays. The Labor Department reported that the economy added 215K jobs in July, slightly below consensus estimates of 222K, and average hourly wages jumped 0.2%. The report is enough to keep the U.S. central bank on track to start hiking interest rates from their near-zero level in September, though I highly doubt these figures were exactly what Federal Open Market Committee members hoped to see.

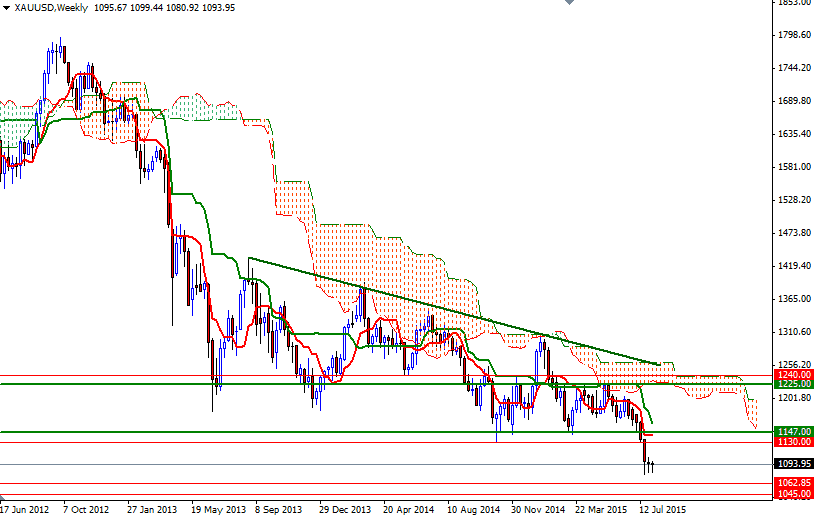

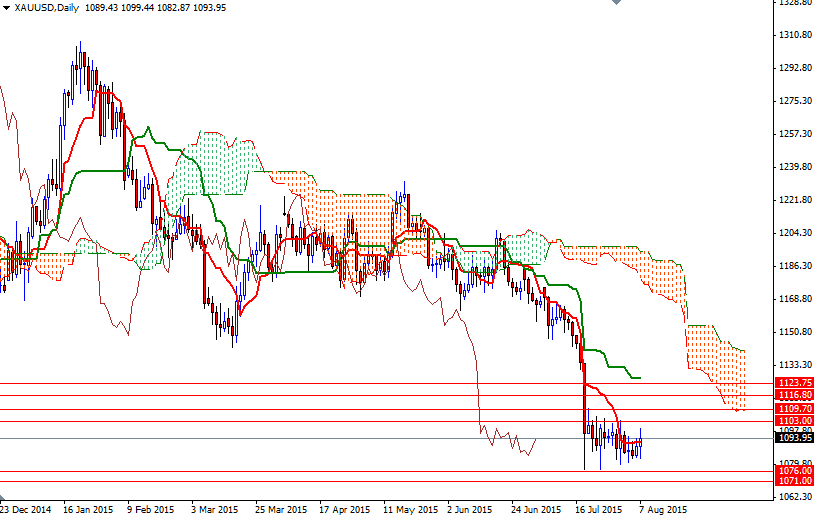

The continued improvement in economic conditions in the last few months has led many in the market to believe that the Fed will tighten its policy before the end of the year. As a result the XAU/USD pair saw the lowest prices since mid-February 2010. However, we have been going back and forth for more than 2 weeks as the battle between buyers and sellers intensified in between the 1103 and 1076 levels. Although the long-term outlook still points to a downwards bias, the short-term picture is unclear and will likely depend on the direction prices will exit.

The first hurdle gold needs to jump is located around the 1103 level but I think the 1109 resistance is going to play an important role as well. If this barrier is breached comprehensively, the bulls might find a chance to push prices towards the daily Ichimoku clouds. On their journey, there will be speed bumps at 1116.80 and 1126.05/1123.75. Beyond that, there is a significant amount of resistance in the 1147/30 area at which a reversal might occur. Currently the initial support is at 1076, followed by 1071. If XAU/USD closes below 1071, there is a strong possibility that the bearish trend will resume and the supports at 1062.85 and 1045 will be tested afterwards.