Gold prices settled at $1115.06 per ounce, gaining nearly 1.9% over the course of the week, as increasing demand for protection against volatility in global equities markets lured some buyers back into the market. Gold had enjoyed a bounce earlier in the week, following the turmoil caused by Beijing's surprising actions, but dented some of those gains after a string of economic data renewed expectations of a September rate hike by the Federal Reserve. The Labor Department said that producer price index advanced 0.2% and the Federal Reserve reported that industrial production jumped %0.6 in July.

The week ahead will see the minutes from the latest Federal Open Market Committee meeting which may provide clues on the exact timing of the lift-off, so the XAU/USD pair is likely to trade sideways near-term. In the meantime, concerns over whether China's devaluation of its currency will continue to pressure the Japanese yen and other Asian currencies could limit the precious metal’s potential downside. From a technical point of view, the recent upswing should remain intact as long as the market can hold above the Ichimoku cloud on the 4-hour time frame.

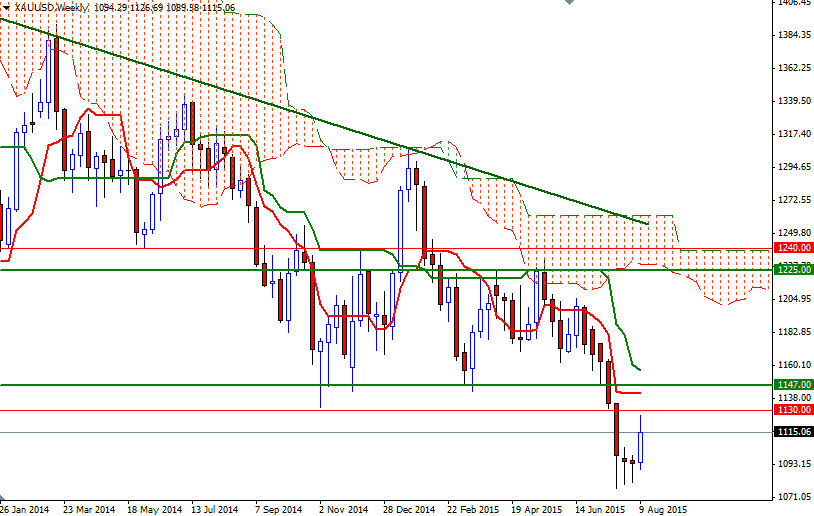

The XAU/USD pair is trading above the clouds and we have a bullish Tenkan-sen (nine-period moving average, red line) - Kijun-sen (twenty six-period moving average, green line) cross on the 4-hour chart. Plus, the Chikou-span (closing price plotted 26 periods behind, brown line) is also moving beyond the cloud. The short-term outlook suggests that there is a possibility of prices testing the 1147/30 area -which had been a major support in the past- before resuming the overall trend and heading lower. The initial resistance level now stands at 1121.75, followed by 1125.50. The bulls will have to push through the 1130 level so that they can gain enough traction to tackle at (1141.32) and perhaps the aforementioned barrier around 1147. However, if the bulls runs out of steam, supports can be found at 1109.70 and 1103. A daily close below 1103 could encourage sellers and drag the XAU/USD pair back to the 1194 level.