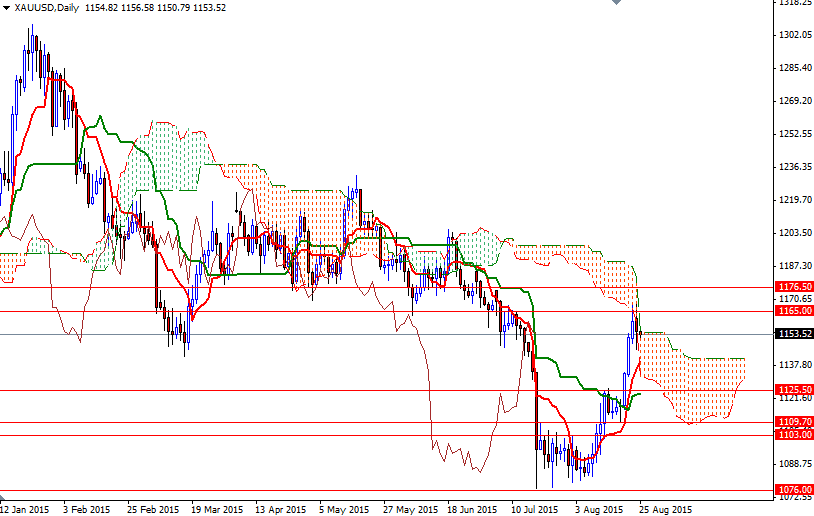

Gold retreated on Monday as investors took profits from a recent rally to a seven-week high. The XAU/USD pair initially tried to break out to the upside but the expected resistance between 1176.50 and 1165 kicked in and capped the market, dragging it back to the previous resistance now flipped to support at 1147.

Since last week, one beneficiary of the stock market sell-off has been gold. Gold historically has always been a safe commodity in times of turbulence but safe-haven gains tend to be short lived and the wider environment remains relatively unfriendly for the precious metal, with the Federal Reserve set to tighten monetary policy later this year. In a speech yesterday, Federal Reserve Bank of Atlanta President Dennis Lockhart said he expects a rate hike sometime this year. Unlike his prior speeches, he didn't repeat his September call though.

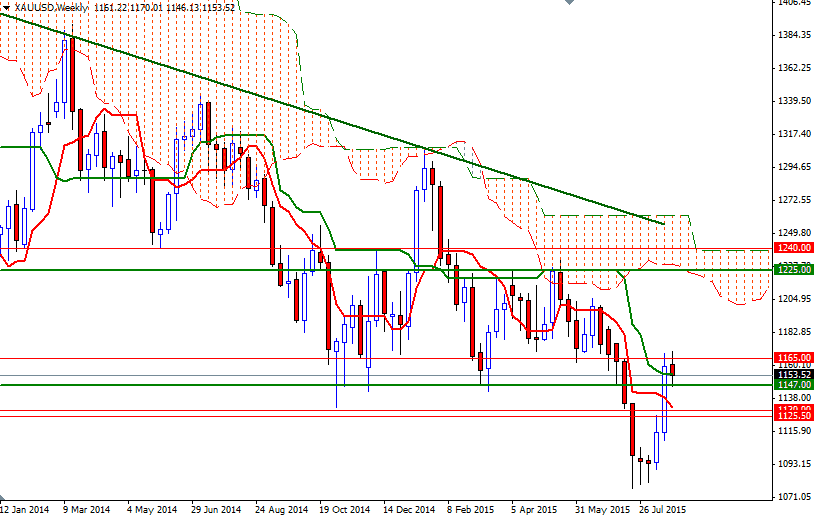

Based on the charts, I think the weekly range will be between 1176.50 and 1140. The market may have gotten ahead of itself and apparently needs to consolidate the recent gains. The fact that we have seen a shooting star followed by a hammer on the 4-hour chart also suggests that we are going to be range bound. From an intra-day perspective, the key levels to watch will be 1150 and 1161. It is quite possible that the pair will gain some traction if it can push through resistance at 1161. In that case, I think the 1165 resistance will be tested. Once the bulls clears 1165 on a daily basis, XA/USD might proceed to 1176.50. However, if the bears take over and prices drop below 1150, we could revisit 1147 afterwards. Shattering this support would make me think that the market will test the 1142/1140 area where the daily Tenkan-sen (nine-period moving average, red line) sits.