Gold prices ended Thursday nearly unchanged as the bulls and bears struggle for near-term control, with neither gaining an edge. The XAU/USD pair lurched lower after the Commerce Department's report showed that gross domestic product expanded at a 3.7% annual pace in the second quarter instead of the 2.3% rate reported last month, though uncertainty over the timing of a U.S. rate rise held losses in check.

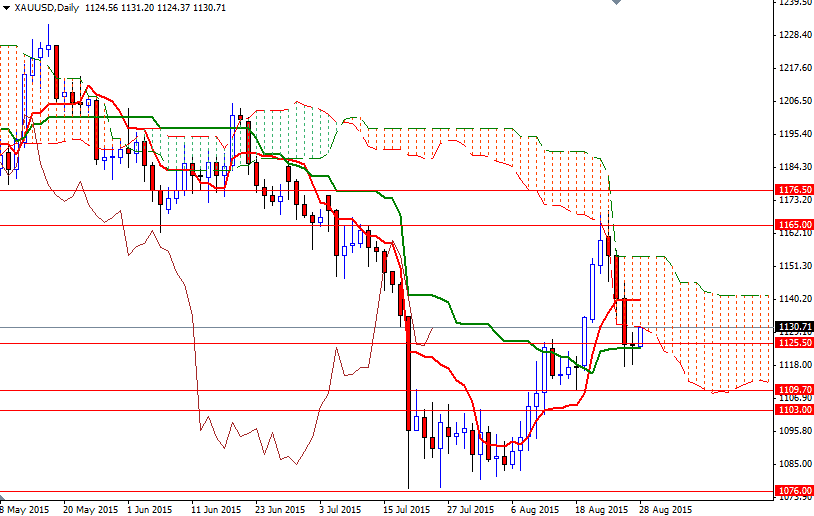

The precious metal is supported by speculations that the Fed might hesitate to raise interest rates in September because of international financial and market developments but still under pressure from a firmer dollar. While I do not discount the possibility of a rebound in the near-term, the technical picture remains weak as the market trades below the Ichimoku clouds on both the daily and 4-hour time frames. XAU/USD is currently trading just above the 1130 level but note that the area between from here until 1147 will be resistive as the daily and 4-hour clouds overlap.

That said, I will keep an eye on the 1135 and 1125/3 levels. If the XAU/USD pair climbs and holds above 1135, we could possibly see the bulls make a run for 1140. They have to pass through the 1140 level where the daily Tenkan-sen line (nine-period moving average, red line) reside in order to proceed to 1147. However, a successful break below the key support at 1125/3 could put extra pressure on prices and send us back to the 1118/6 region. If the bears eliminate this suppport, look for further downside with 1109.70 and 1103 as targets.