Gold continued to retreat from a seven-week high struck this week, as safe-haven buying subsided after the news that China slashed interest rates and banks' reserve requirements helped stabilize global markets. A rebound in the dollar also weighed on the precious metal. On the economic data front, Markit's preliminary reading on the U.S. service sector came in better than expected with a print of 55.2 and the Conference Board reported that its consumer confidence index jumped to 101.5 from 91 the prior month.

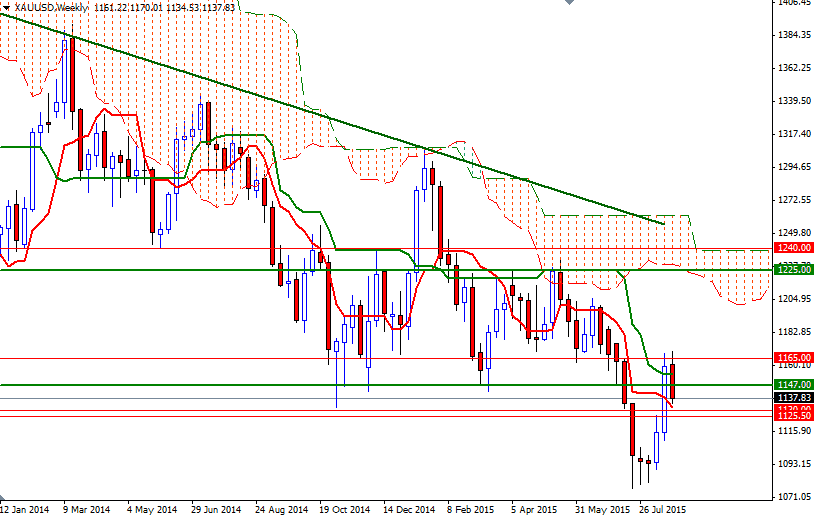

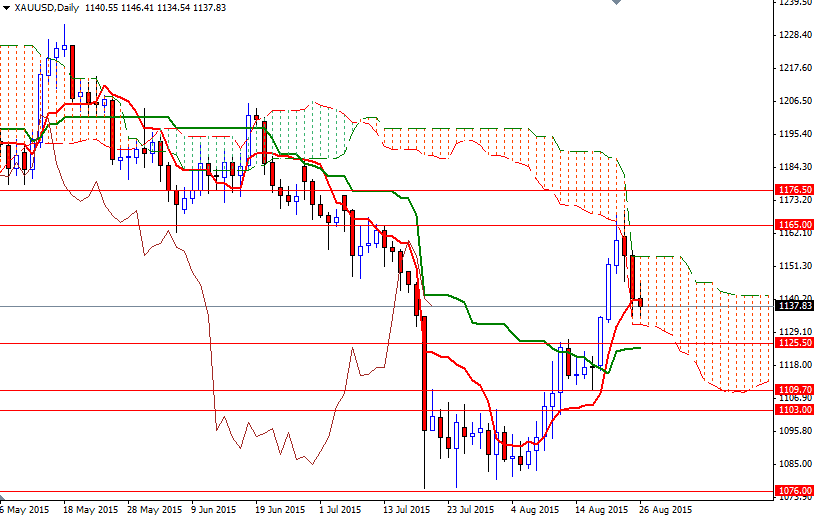

Apparently, China's moves to calm stock markets sapped investors' interest in haven assets but there is no doubt that the bulls will try to take advantage of any destabilization in the risk environment. However, as you can see on the daily chart, the Ichimoku clouds continue to maintain a constant pressure on the XAU/USD pair. Dropping back below the 1147 level is another thing to pay attention to at this point because it dragged the Tenkan-sen line (nine-period moving average, red line) behind the Kijun-sen line (twenty six-period moving average, green line) on the 4-hour time frame.

The short-term outlook suggests there is a possibility that the market will revisit the 1125.50 - 1123 area. But of course, in order to reach there, the bears will have to eliminate the support at 1131/0 where the bottom of the daily cloud sits. If this support (1125.50 - 1123) is broken, the 1116 level will probably be the next port of call. On the other hand, if the bulls manage to dodge incoming attacks and the 1131/0 support remains intact, expect a push up towards 1147. Closing above 1147 would indicate that the bulls are getting ready to tackle the next barriers located at 1150 and 1155.