Gold prices ended the week up nearly 4.1% to settle at $1159.83 an ounce, the highest level since July 14. Plunging equities markets caused by China's economic woes, the trouble in emerging markets and a reduced likelihood of a September rate hike by the Federal Reserve drove strong gains for gold last week as investors sought safe haven assets. The world's major bourses suffered bruising losses after a report from China showed manufacturing activity shrank at the fastest pace in 6-1/2 years and the dollar extended its losses which were triggered by dovish-leaning minutes of the Federal Reserve's July meeting.

The fear factor and increased risk in global equity markets may prompt investors to ignore economic reports out of the United States for a while. If concerns about a stronger correction continues to dominate markets, more investors could take profits off the table in equities and use it to increase their gold holdings. As I occasionally emphasize, I believe the precious metal’s fate will depend on the Fed’s decision on interest rates (dictated by economic growth) and overall performance of the stock markets (simply what direction it will take).

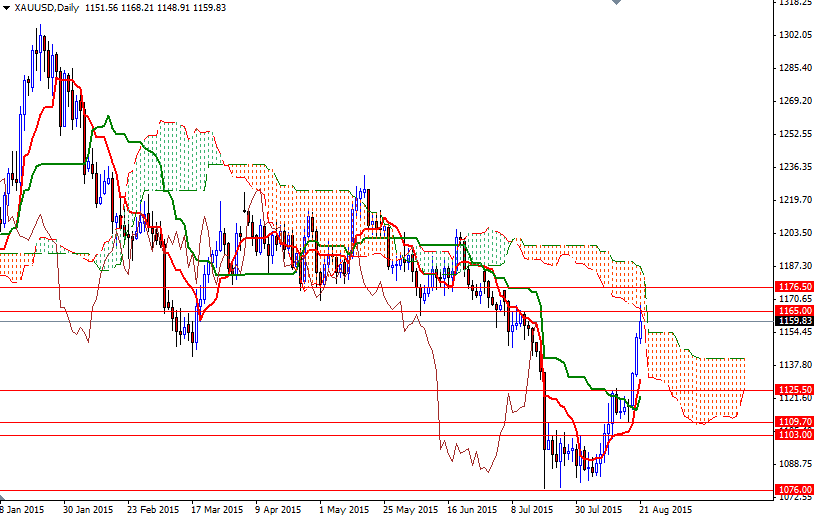

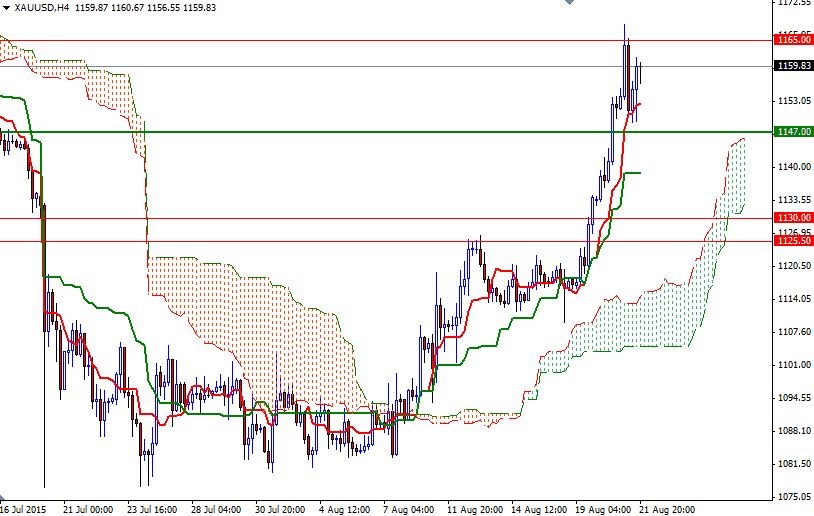

Technically, the odds have been favoring the bulls since the XAU/USD pair climbed above the 1109.70 level. However, I would advise caution at this point because the daily Ichimoku cloud offered resistance as expected. If the bulls continue to encounter heavy resistance between the 1176.50 and 1165 levels and prices start to fall, we may head back to the 1153/1 area where the Tenkan-sen (nine-period moving average, red line) resides on the 4-hour chart. I think the bears will need to drag the market below the 1151 level in order to tackle the next support located at 1147. If this support gives way, all attention will turn to 1142. As you can see on the daily chart, there is a significant amount of support in the vicinity of 1165 and because of that it will be a pretty tough nut to crack. If XAU/USD rockets up and breaks through 1165 convincingly, we could see a continuation towards 1176.50. Only a daily close above 1176.50 could provide the bulls the momentum they need to march towards the 1190 - 1185 resistance.