Gold prices ended the month up roughly 3.5% at approximately $1134 an ounce, benefited from uncertainty posed by China's surprise devaluation of its currency. Growing concerns about the health of the Chinese economy rattled investors and shook markets around the world. The bulls took advantage of the volatile global stocks sell-off which whetted appetite for safe-haven assets, however, good U.S. economic data kept alive the prospect of the Federal Reserve hiking interest rates this year.

The week ahead may get off to a slow start, with investors sitting on the sidelines ahead of the key economic releases. Chinese markets will also be on people's radar. In a speech at an annual economic conference in Jackson Hole, Fed Vice Chairman Stanley Fischer said

"With inflation low, we can probably remove accommodation at a gradual pace...Yet, because monetary policy influences real activity with a substantial lag, we should not wait until inflation is back to 2% to begin tightening...At this moment, we are following developments in the Chinese economy and their actual and potential effects on other economies even more closely than usual".

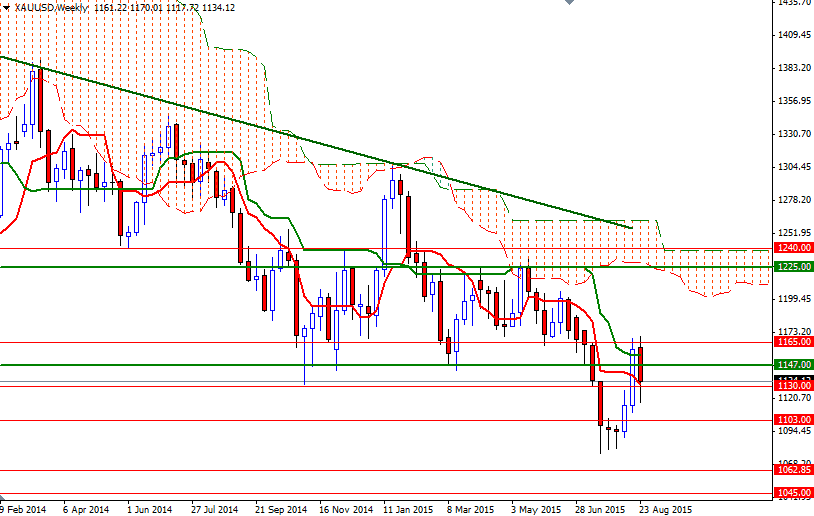

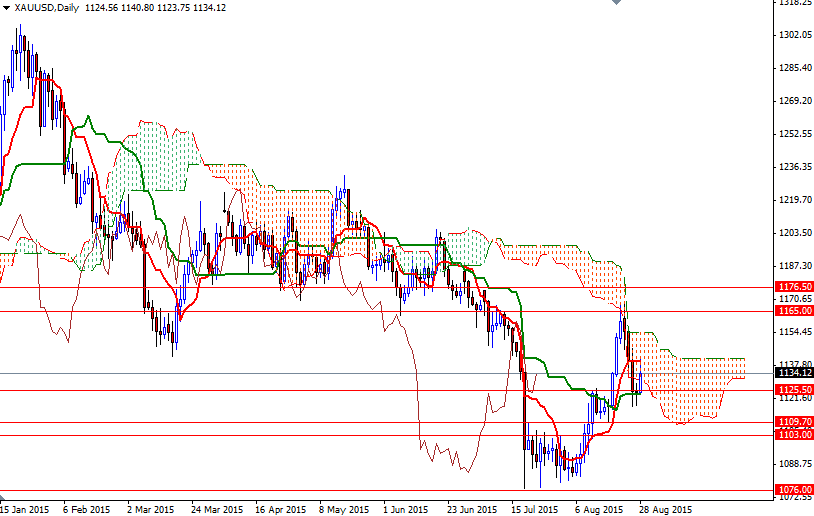

The long-term technical picture remains weak, with the market trading below the Ichimoku clouds on the weekly time frame, plus we have negatively aligned Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-period moving average, green line) lines. I expect the area between 1138 and 1151 to be highly resistive as the daily and 4-hour Ichimoku clouds overlap. If the bulls clear a bunch of resistance levels clustering this region, we could see the XAU/USD pair extending its gains and approaching the 1176.50 - 1165 area. A close above 1176.50 on a weekly basis would prolong the bullish momentum and clear the path towards 1200. On the other hand, if the bears increase the downward pressure and prices start to fall, support may be seen at 1125.50 and 1116. Dropping through 1106 would imply that the next possible targets will be 1109 and 1103. Once below the 1103 level, there is a strong possibility that prices will head back to 1076.