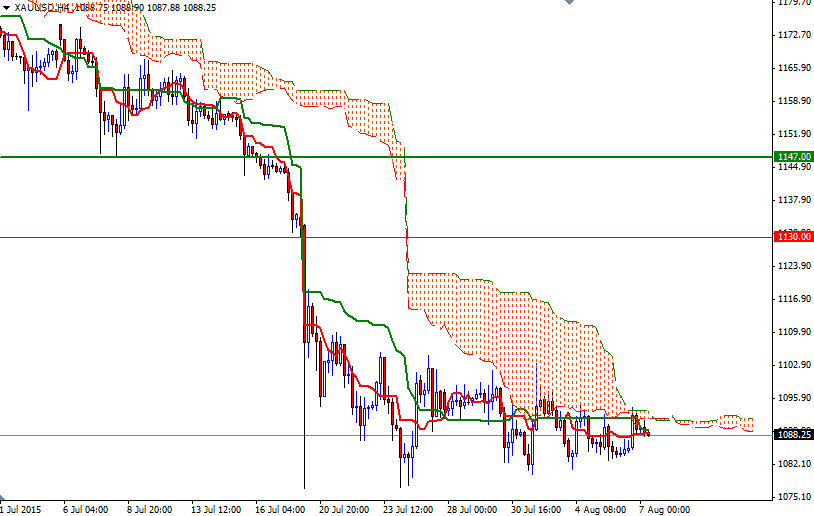

Gold prices advanced $4.57 an ounce yesterday as a slump in global equities and the retreating U.S. dollar provided some support to the precious metal. The XAU/USD pair turned higher and touched $1093.98 after the Labor Department reported initial jobless claims rose by 3K to 270K. The tightening trading range that dominated the price action for the past two weeks shows the majority of traders are cautious and hesitant to make aggressive bets ahead of highly anticipated U.S. jobs data that may help determine whether the Federal Reserve could raise interest rates in September.

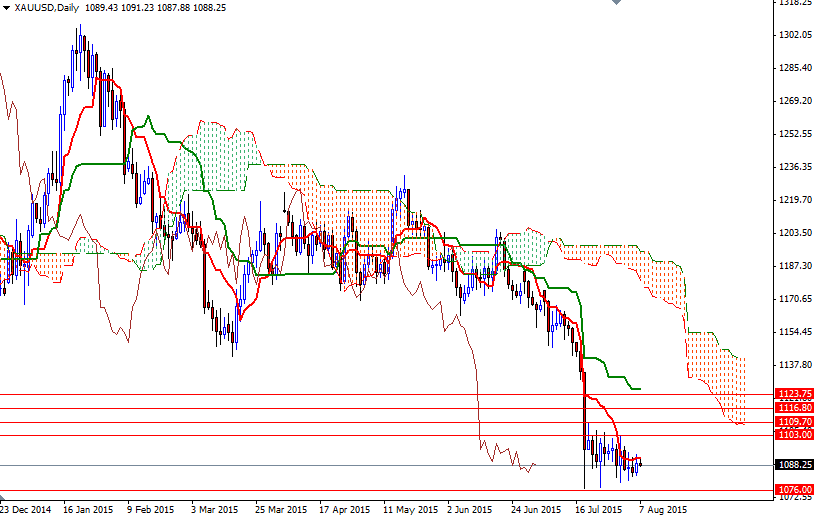

A solid U.S. payroll reading may send the XAU/USD pair below the 1076 level and put some extra pressure on prices. Breaking below the next support at 1071 would imply that the 1062.85 level will be the next stop. If this critical support is broken, prices could collapse all the way down to 1045.

On the other hand, if the numbers come in worse than expected, it wouldn't be so surprising to see a relief rally. In that case, the key level to pay close attention will be 1103. Beyond that, sellers will be waiting at the 1109 level. The bulls have to capture this strategic fort so that they can gain enough traction to head towards the 1126.05 - 1123.75 area where the daily Kijun-Sen (twenty six-period moving average, green line) sits.