The gold market started the month on the back foot, reflecting sustained pressure on prices, as the conditions in the marketplace gave investors few reasons to invest in the precious metal. Despite weaker-than-expected manufacturing data out of the United States, growing conviction that the Federal Reserve will begin altering its monetary policy as early as its next meeting in September continues to maintain a constant pressure on the market. Last week, the Fed said that it was on course to hike interest rates unless the domestic economy is disrupted unexpectedly. Concerns over the weakening Chinese economy is another reason why gold has been struggling.

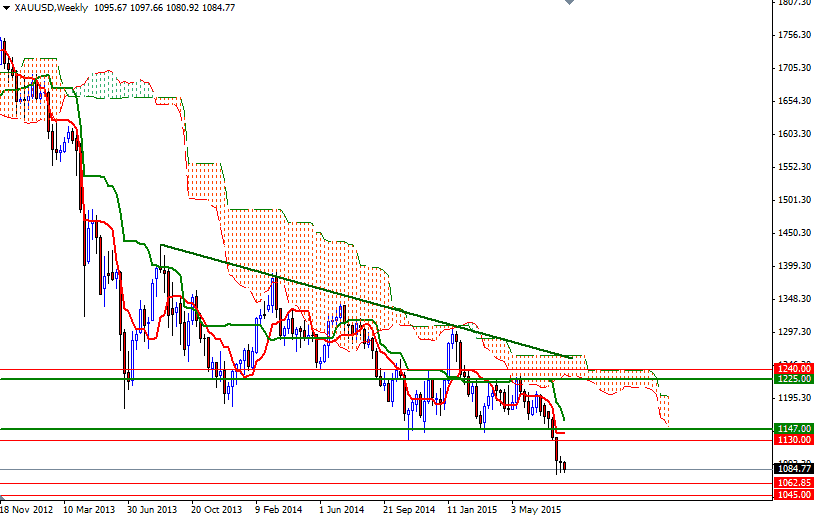

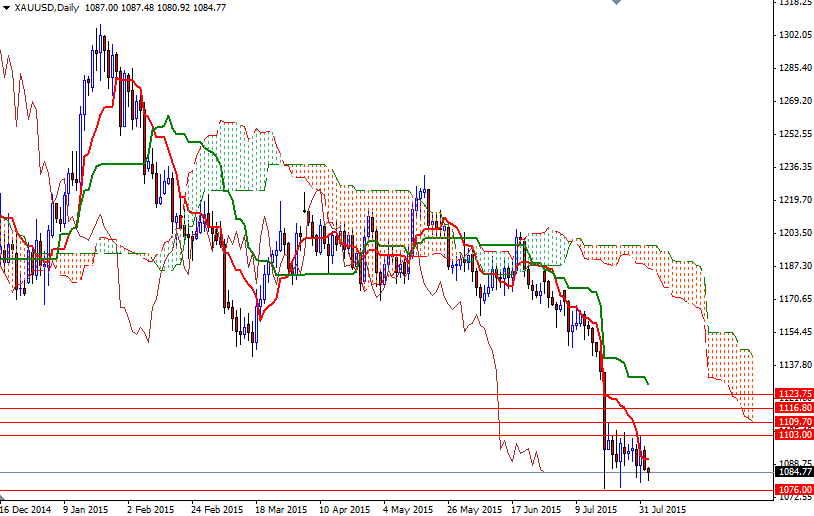

The majority of market participants are already looking ahead to Friday's non-farm payrolls report. In the mean time, I expect the market to continue consolidating between the 1109.70 - 1103 area on the top and the 1076 - 1071 area on the bottom. Technically, trading below the Ichimoku clouds on both the daily and 4-hour charts gives the bears an advantage over the medium-term.

The bulls will have to convincingly push the market above 1103 so that they tackle the next barrier at the 1109.70 level. Since that would carry the market beyond the Ichimoku clouds on the 4-hour time frame, it would be technically possible to see the XAU/USD pair visiting the 1116.80 and 1123.75 levels. However, if the support at 1076 fails to hold the market, then the 1071 level might be the next port of call. Closing below the 1071 support would open up the risk of a move towards 1045. On its way down, support can be seen at 1062.85.