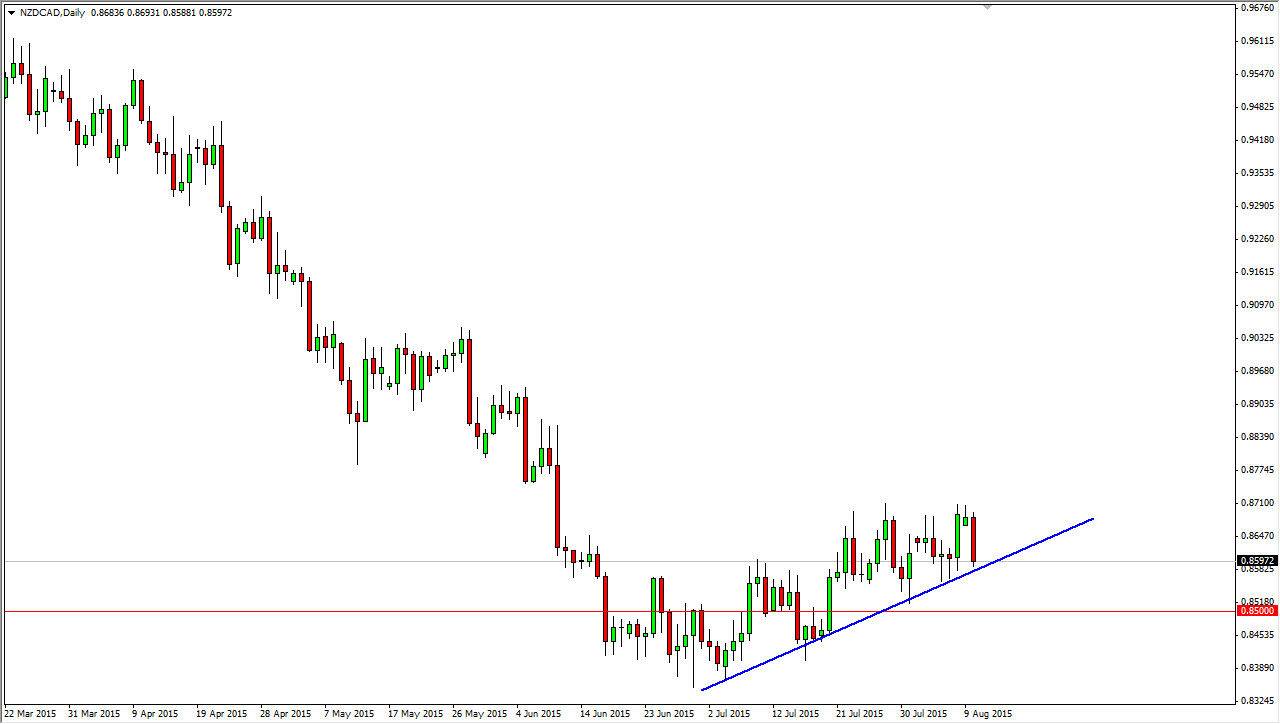

The NZD/CAD pair continued to show weakness on Monday, as the markets crashed into the uptrend line on the chart. I believe that this market is ready to go much lower, but we need to not only break below this uptrend line, but perhaps break down below the 0.85 level as it is a large, round, psychologically significant number. I think eventually this does happen, simply because the New Zealand dollar is that soft. I am not a fan of the Canadian dollar, but the one thing Canada has is the ability to ride the coattails of the US economy, which of course is an enviable place to be at the moment.

I don’t like commodity currencies in general, but the reality is that the New Zealand dollar is more susceptible to commodities when it comes to Asia, which of course is slowing down in general. At least the Canadians can sell their oil to the Americans, so this of course means that in general it should do a bit better. This means that the market should continue the longer-term trend, and quite frankly at this point in time I do not have a scenario in which I am willing to buy this pair.

Even if we did bounce…

Even if we did bounce from here, the truth of the matter is that the move higher has been a grind, and not a significant move. With this, I have no interest in wasting my time with that type of movement. I believe that there are easier ways to make money in the Forex world at the moment, so I’m simply trying to trade with the overall trend when it comes to currency pairs right now. I am not looking for some type of massive turnaround in any of these markets, so I am trying to be as patient as possible. The lack of liquidity in the Forex markets at the moment simply do not allow me to start placing reckless trades at this point. I am simply selling or doing nothing in this market.