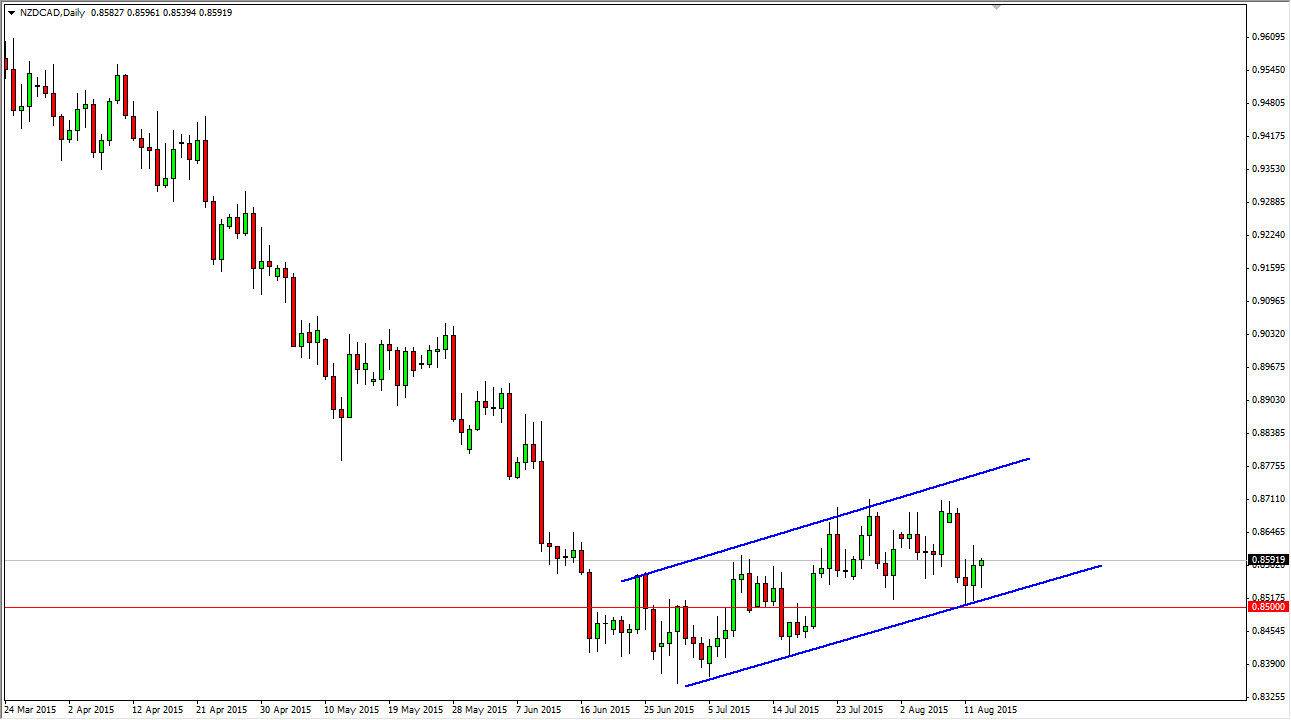

The NZD/CAD pair initially tried to fall during the session on Thursday, but found enough support to turn things back around to form a hammer. The market has recently been following an upward channel for some time now, as we grind higher. The 0.85 level below should be supportive, but at the end of the day we are still very much in a downtrend. The upward channel is a short-term correction in our opinion, but I am willing to take the countertrend trade winds this clearly defined.

However, I don’t necessarily think that we’re going to break above the top of the upward channel, as the 0.8725 level should be resistive. With that being the case, the market offers a short-term buying opportunity. However, I think sooner or later we will find enough resistance to turn things back around and break down below the bottom of the channel.

0.85 is important

The 0.85 level below been broken to the downside would be a very negative sign, as it would show the New Zealand dollar breaking down. Although I do not like the New Zealand dollar at the moment, when you look at the NZD/USD pair, you can see that the market is trying to bounce just a bit. Because of this, it should translate into this pair going higher. After all, the USD/CAD pair is working against the value the Canadian dollar, so it’s a bit of a triangulation in order to find the trade in this market.

Oil isn’t exactly looking that strong and it continues to work against the Canadian dollar, although on the same hand you can say that the New Zealand dollar is in exactly been helped by the Asian economies either. With this, this is a simple battle of 2 very soft currencies. At this moment though, I think that the longer-term downtrend should continue given enough time. Short-term buying is possible, but longer-term downtrend has to be thought of.