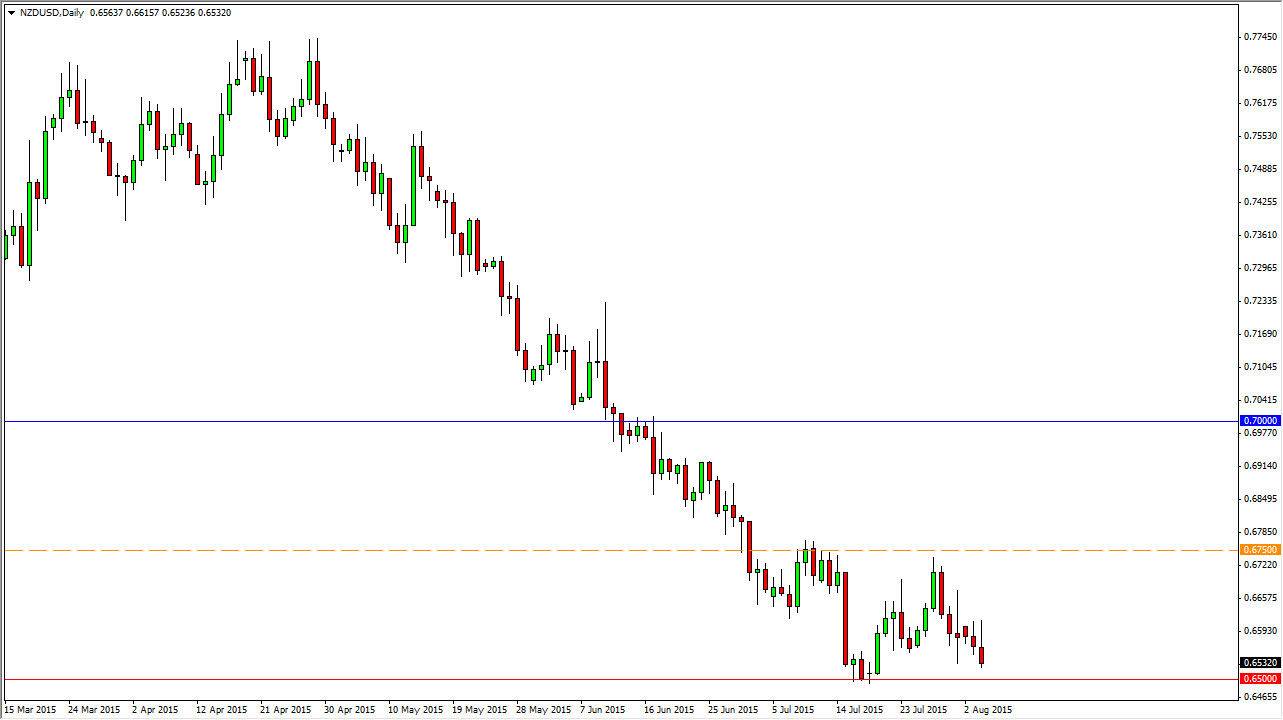

The NZD/USD pair initially tried to rally during the course of the day on Tuesday, but turned back around at the 0.6650 level to fall significantly and form a shooting star. The shooting star sits just above the 0.65 handle, which has recently been the bottom of the market. It is a large, round, psychologically significant number, so of course there is going to be a certain amount of support just because of that particular reason. With the shape of the candle, I believe that the market is trying to break down, and if we can get below the 0.65 handle, I believe that the market will then head towards the 0.64 level first, and then eventually the 0.6250 level after that. Quite frankly, this point in time I think that anytime this market rallies, you have to be very suspicious and start looking for selling opportunities.

Commodity markets

The commodity markets right now are simply offering no support for commodity currencies such as the Kiwi dollar, so it makes sense we continue to go lower. Quite frankly, the demand around the world for commodities in general isn’t exactly strong, and that’s going to be especially negative for the Kiwi as it is a barometer of commodity demand and risk appetite in general. This will continue to be a problem for the NZD, so I am a seller of this currency in general. The markets should continue to be volatile, with a downward bias as we continue.

The summer isn’t exactly the time of year to anticipate larger move in the currency markets, especially ones that are influenced so heavily by the commodity markets. With the Asians slowing down as well, I think this pair will continue to offer selling opportunities for the foreseeable future, and I have absolutely no interest in buying until we are well above the 0.76 level. I don’t think that is going to happen for some time. I continue to sell again and again on shorter time frame charts.