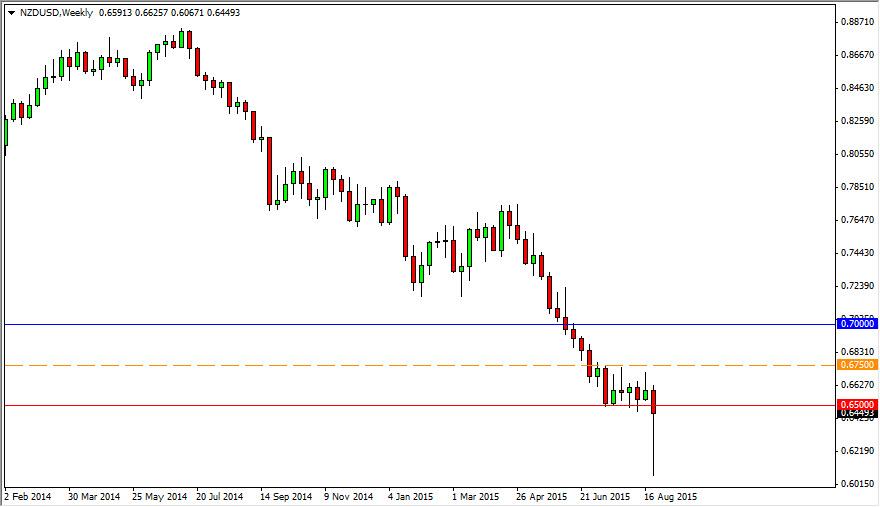

The NZD/USD pair broke down significantly during the end of the month of August, but just as brutally as we sold off, we bounced. The 0.60 region offered enough support to turn everything back around and form a massive hammer. The month of August was extraordinarily volatile, and a pair like the New Zealand dollar/US dollar pair is going to be extraordinarily volatile due to the fact that it is one of the least liquid major pairs out there.

Keep in mind that the Kiwi dollar is of course sensitive to the commodity markets, so that more than likely will be influential. However, the Chinese have established even more quantitative easing, and that should in theory bring up the demand for commodities in the mainland. However, you have to keep in mind that regardless what happens next there will be a lot of volatility due to the fact that there are always going to be questions about whether or not the Chinese can continue the growth that we’ve seen over the last several decades. At this point in time, I don’t think it’s going to happen.

Nonetheless, follow the charts

I think the Chinese story is going to slow down, but you have to keep in mind when it comes to China a slowdown could be something like 4.5%. That would be extraordinarily slow for China, but a growth rate that most countries around the world would kill to have. With that being the case, I think that the New Zealand dollar is a bit oversold, and the fact that we formed a hammer seems to signify that may very well be the case.

On this chart, I haven’t dashed the orange line at the 0.6750 level. I think if we can break above there we will more than likely head to the 0.70 level, looking for resistance. A break above there could make things truly interesting as it could signal we are finally changing trends. Even if we drift a little bit lower in this pair, I think the fact that we formed such a massive hammer shows that there are going to be buying opportunities at lower levels off of supportive candles. At this point in time, I think the New Zealand dollar will probably have either found the bottom of the trend, or come close to it by the time we finish the month.