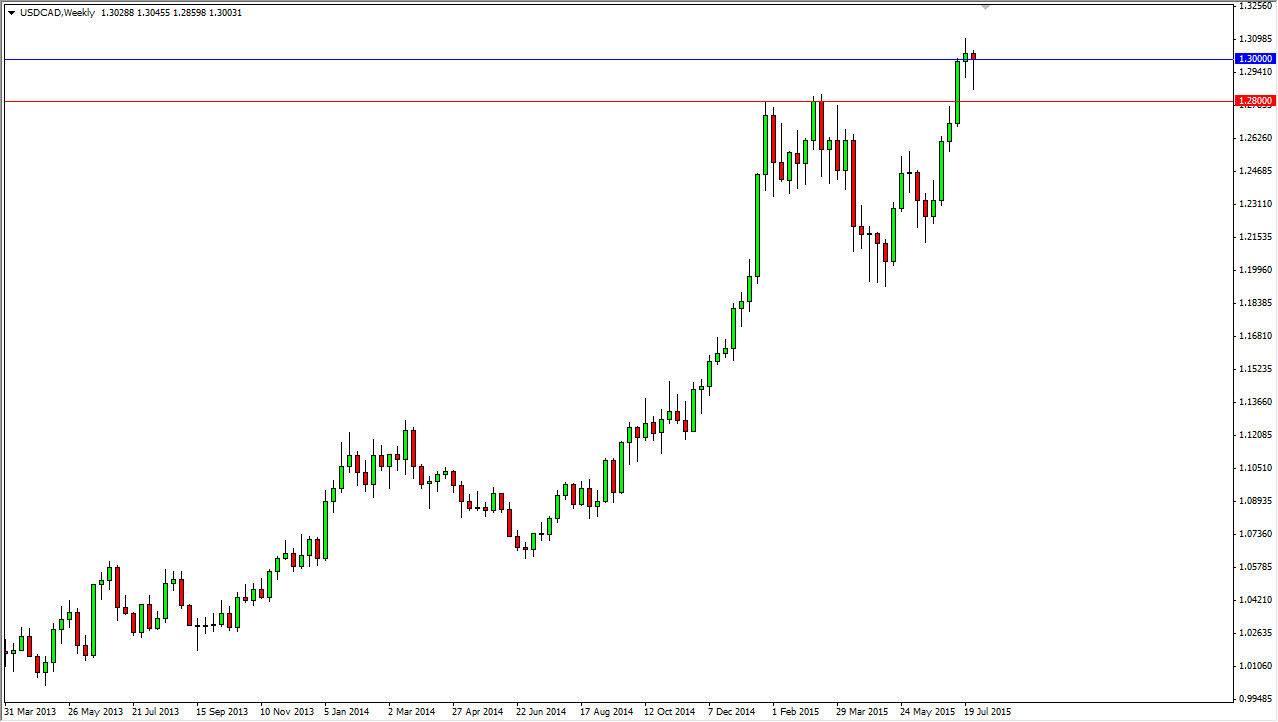

The USD/CAD pair fell during the last week of July, but as you can see we found plenty of support at the 1.28 level. In fact, that was probably the most important thing to happen during the course of the month, breaking above the 1.28 handle. Now that it has proven itself to be somewhat supportive, I believe that the market is ultimately going to break out to the upside. Yes, I look at the 1.30 level as the real gateway to higher rates, but at the end of the day we have shown enough momentum to the upside think it’s only a matter of time.

For those of you have not been trading that long, the 1.30 level was the area where this pair stopped dead in its tracks several times after the financial crisis. Because of that, I think that “market memory” is at play here, and as a result it is going to take more attempts to get through. However, I think we will sooner or later.

Buying dips

The meantime, I am simply buying dips in this pair. I think that will be the way going forward for several months, as we should have a “buy-and-hold” type of mentality. I think that the oil markets will continue to soften up, and that should continue to drive down the value of the Canadian dollar in general. The US dollar is strengthening in general, and with that I think that makes a bit of a “perfect storm” when it comes to this particular pair. On top of that, we know that the Federal Reserve is going to raise interest rates fairly soon, and the Bank of Canada had a surprise interest-rate cut not too long ago. With that, I think there are too many reasons the think that this market will continue to go higher to even consider selling at this point in time. The markets will continue to go higher given enough time, but you’re going to have to be patient as the month of August tends to be very quiet.