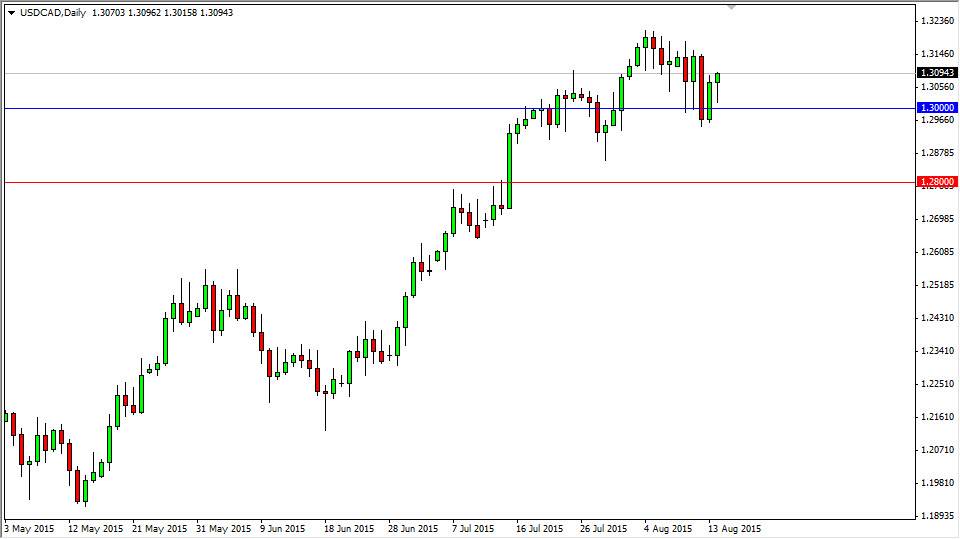

The USD/CAD pair initially fell during the course of the session on Friday, but found enough support near the 1.30 level to turn things back around and bounce significantly. That bounce ended up forming a hammer, and the hammer of course is one of the more bullish candlesticks that we can find. The marketplace had plenty of resistance near the 1.30 level previously, because that is where the market stopped dead in its tracks several times during the financial crisis. With that, it should now offer support, and I also believe that the support area is essentially between the 1.30 level and the 1.28 level. Because of this, I think that there is more than enough support below to keep this market afloat.

Oil markets

I also recognize that the oil markets are falling apart again and again, and that of course continues to put quite a bit of pressure against the Canadian dollar. After all, the Canadian dollar is traded by Forex traders as a proxy for crude oil, and as long as those markets are soft, it’s hard to imagine that the Canadian dollar will skyrocket in value.

Any pullback at this point in time should have plenty of support below, so really at this point in time I have no interest whatsoever in selling this market. In fact, if we drift a little bit lower I would anticipate that the buyers would get even more aggressive about going long. The US dollar is strengthening in general, and of course commodity currencies all look very soft. Although the Canadian dollar isn't necessarily as vulnerable as the Australian or New Zealand dollars, the truth of the matter is that the currency is simply the strongest currency among the group of the weakest currencies that we follow. With this, I think that it’s only a matter of time before we rally again and again, with myself adding to each dip.