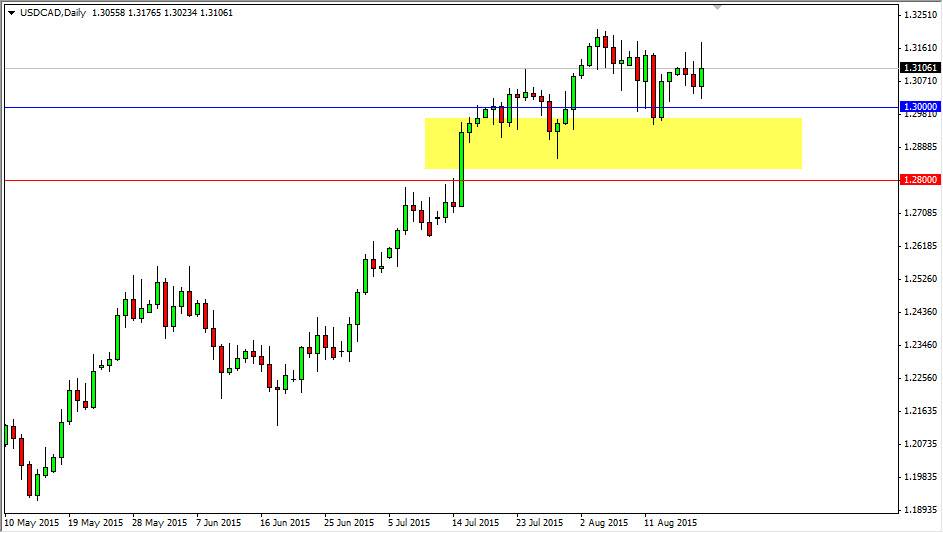

The USD/CAD pair initially rose during the course of the session on Wednesday, but found far too much in the way of resistance above. Because of this, the 1.32 level looks to be even more resistant than previously thought, and I think we are going to have to seriously fight to break out above there. I do think it will happen given enough time, but this is probably the wrong time of year to anticipate the type of momentum needed to push this market higher. I think if we can break above the top of the candle for the session on Wednesday that would be a very bullish sign. But to be honest, there are other ways that I would buy this pair as well. After all, there is a significant amount of support just below, and I think that will continue to be the case going forward. I think the support still runs from the 1.30 level all the way down to the 1.28 handle. Any type of supportive candle in that general vicinity would be reason enough to start going long as far as I can see.

Oil markets aren’t helping

The crude oil markets out there certainly are not helping the Canadian dollar either. Remember, the Canadian dollars quite often traded as a proxy for crude oil by Forex traders, and as a result it will rise and fall in value as the oil markets do also. After all, the more demand there is for oil, the more demand there should be for the Canadian currency as there are so many crude oil companies in that country.

With this being said, I believe that we do pullback a little bit based upon not only the significance of this general vicinity, but the fact that we formed a little bit of a shooting star. Regardless, I have no interest in selling this pair, I do believe that eventually we get a supportive candle needed in order to start buying again.