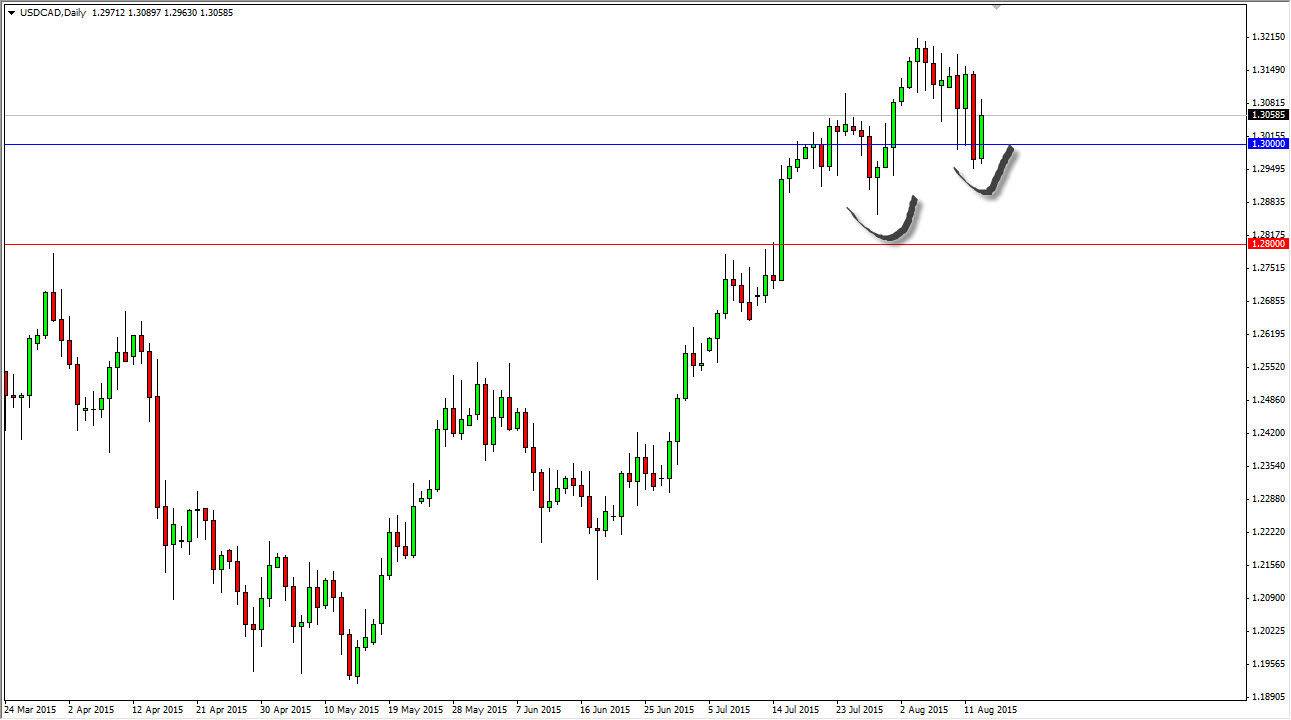

The USD/CAD pair bounced off of the area just below the 1.30 level, so now looks as if the market is ready go higher. We have made a “higher low” now, and if we can continue to go higher and break above the top of the range we should continue to see this market go higher. After all, the US dollar is without a doubt one of the strongest currencies in the world, and we also know that a lot of the fundamentals are working against it right now. After all, you have to keep in mind that the oil markets are doing absolutely nothing to propel the value of the Canadian dollar higher, so this market should continue to grind upwards.

I do think that eventually we break out and head to much higher levels. I believe this could be the beginning of a multi-tier move higher if the oil markets cooperate. They don’t necessarily look like the ready to start rallying at this point in time, so at this moment I still believe that this market goes higher. I also recognize that there is massive support all the way down to the 1.28 handle, so I have no interest whatsoever in selling.

Adding on dips

I’m adding onto longer-term positions on short-term dips, in small increments. After all, this pair does tend to grind quite a bit, and with that it would make sense to see this market go back and forth over the longer term, but eventually we should see the buyers when out. After all, these 2 economies are highly leveraged towards each other, and as a result the market typically struggles to make any significant moves in one shot for any real length of time. However, what times you have a sudden move, followed by a lot of consolidation. Ultimately, I think that this is a “buy only” market, which means of that if you are patient enough, you should make some decent money to the upside.