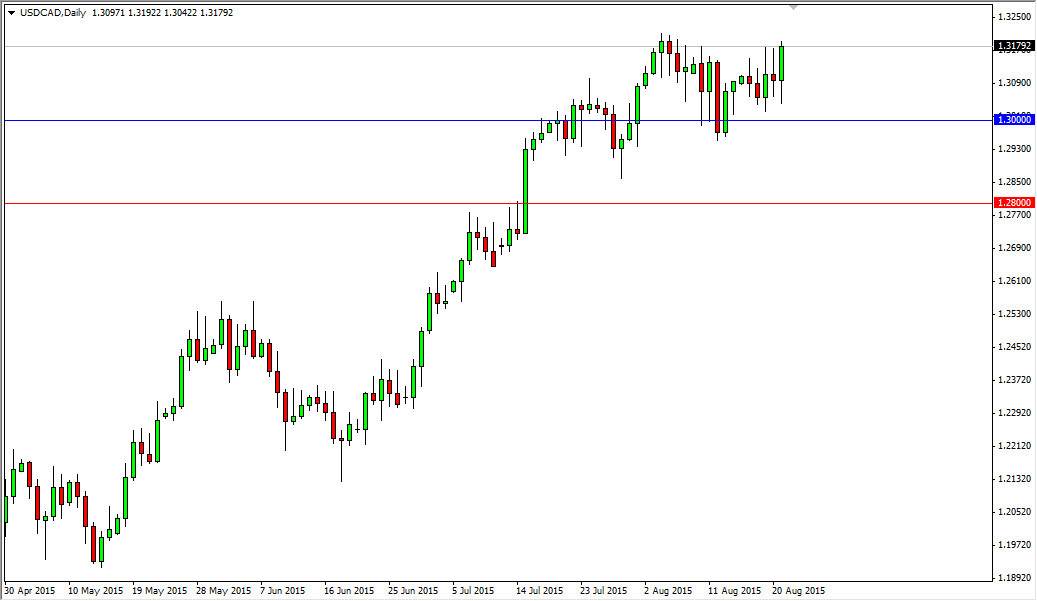

The USD/CAD pair initially fell during the course of the session on Friday, but as you can see found quite a bit of support just above the 1.30 level. Because of this it looks as if the market is ready to continue going higher, and perhaps head towards the 1.35 level given enough time. I recognize that the 1.32 level above is resistive, but quite frankly I think we are simply trying to build up enough momentum to finally break out. Oil markets look absolutely horrible at the moment, and that of course will work against the value the Canadian dollar overall. Ultimately, this pair is quite often driven by crude oil in general, and as a result it probably will continue to go higher sooner or later.

Buying pullbacks

On simply buying pullbacks from time to time, taking advantage of short-term moves, eventually, we will break out to the upside and I think we will go to the 1.35 level as mentioned above. Ultimately, that we go above there as well, but we are in the wrong time year to see some type of massive move, simply because the volume isn’t there right now. After all, the market is missing a lot of the larger traders out there as most of the big firms are away on vacation. Ultimately though, this market will eventually get the volume needed to finally make a break out, and then we will continue.

Even if this market fell below the 1.30 level, I think there’s plenty of support all the way down to the 1.28 handle, and therefore I think that it would only be a matter of time before the buyers stepped back into this marketplace and I would be very interested in going long on supportive candles down there as well. In other words, there’s really no way to sell this pair right now as it is simply just far too strong to the upside.