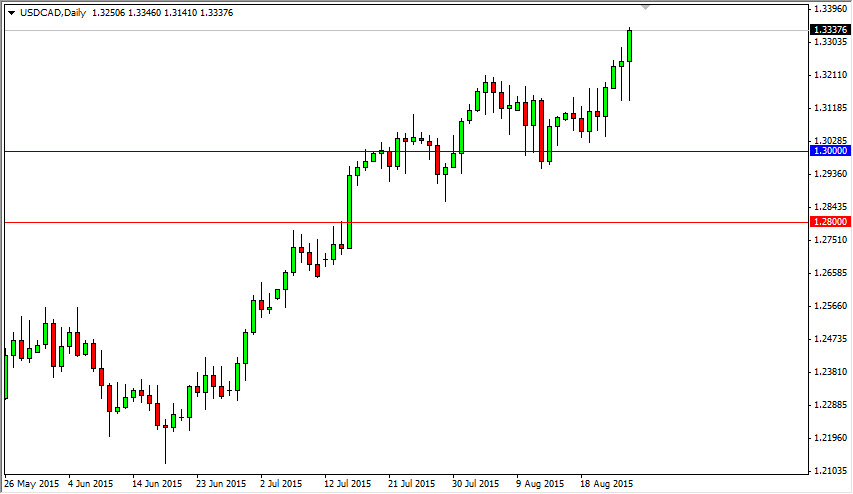

The USD/CAD pair initially fell during the session on Tuesday, but found support at the 1.3150 region in order to turn things back around and form a rather positive looking candle. Because of this, it appears that the market is going to continue to go higher, and the fact that the US dollar gained on the Canadian dollar during the very same session that oil markets bounced tells me just how soft the Canadian dollar is going forward.

The 1.30 level was a significant barrier of resistance, and the fact that we broke above there is of course a very positive sign. This was where the financial crisis was stopped several times in this market. The fact that we are above that level now suggests that perhaps we are going to continue to grind away higher. On top of that, the pair does tend to grind in general. With that, I am not looking for any type of massive move in the short-term. However, I do think that we eventually go much higher.

Intertwined economies

The economies of both Canada and the United States are heavily intertwined, and with that it makes sense this pair doesn’t exactly skyrocket in one direction or the other. However, the longer-term trend does tend to be very stable in this market, and as a result it can be a very profitable market to trade. You have to be patient in order to hang onto the trade as needed, but ultimately it comes down to comfort.

I believe that buying dips on the way higher and it will be the way going forward, and I also recognize that the 1.30 level below should be rather supportive. I think it’s essentially a “floor” in this market, and the action that we’ve seen over the last couple of days only solidifies that thought in my head. With this, I continue to be very bullish of this pair.