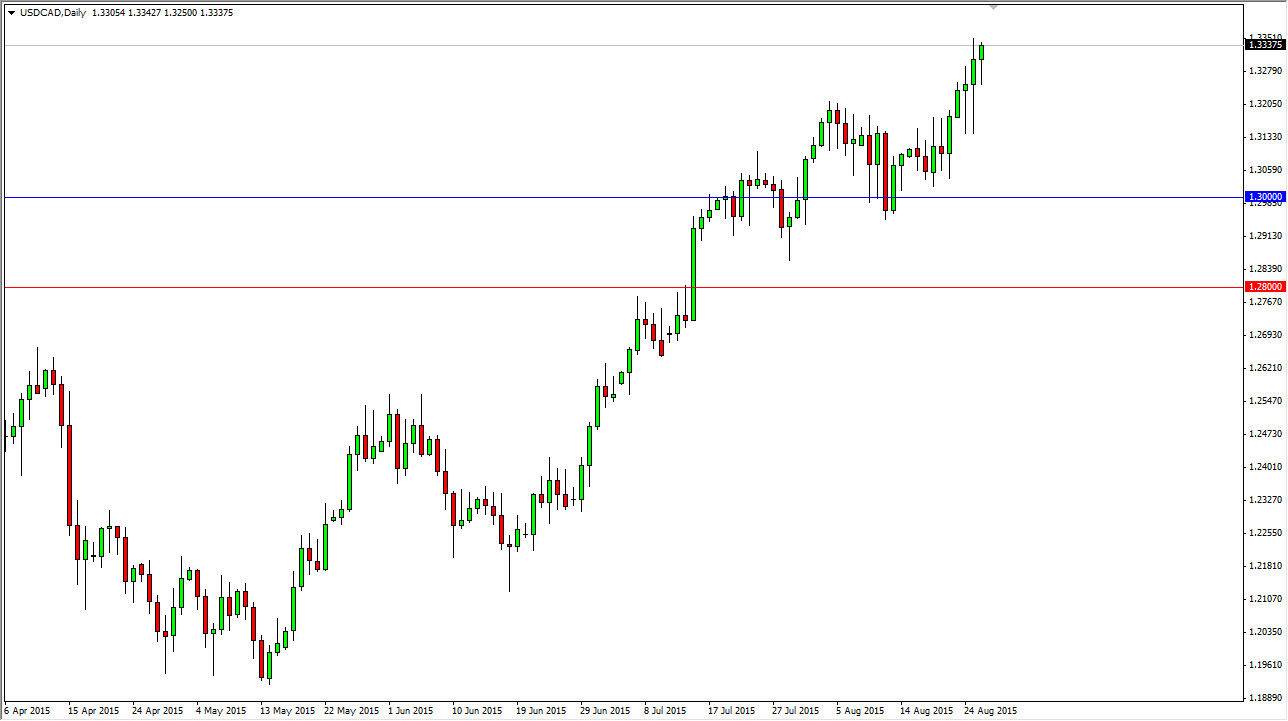

The USD/CAD pair fell during the course of the day on Wednesday, but found support yet again down near the 1.32 handle. By doing so, we bounced and formed a nice-looking hammer, which of course is a bullish sign. With that, I believe that we are going to continue to go higher, and of course that makes sense as it is with the overall trend, and the fact that we’ve seen hammers on all three days this week. Because of this, I think that there is significant buying pressure underneath, and as a result I don’t see any reason to think that we’re going to selloff for any significant amount of time, and every time we pullback should end up being a buying opportunity.

There is simply no reason to think that the Canadian dollar is going to strengthen anytime soon, because it is essentially a proxy for the oil markets. The oil markets look horrible, and they look like they are going to continue to sell off going forward. As long as that’s the case, I don’t see any reason why the Canadian dollar shouldn't gain in strength.

Oil glut

The oil glut will continue to work against the value of the Canadian dollar, but ultimately it is also a reevaluation of interest-rate differential and expectations. The interest-rate differential between the two currencies should continue to tighten, as the central banks will be on 2 different paths. On top of that, keep in mind that the US dollar does tend to be a bit of a “safety currency”, especially when there’s times of massive volatility. We have certainly seen that over the last couple of sessions, so quite frankly this doesn’t surprise me.

I believe that the 1.30 level below is massively supportive, and that it’s only a matter of time before markets would welcome buying back in and if we did fall to that level. Ultimately though, I don’t think we are going to be able to, and that every time we dip you have to think about buying. 1.35 will of course be resistive, but probably broken above given enough time.