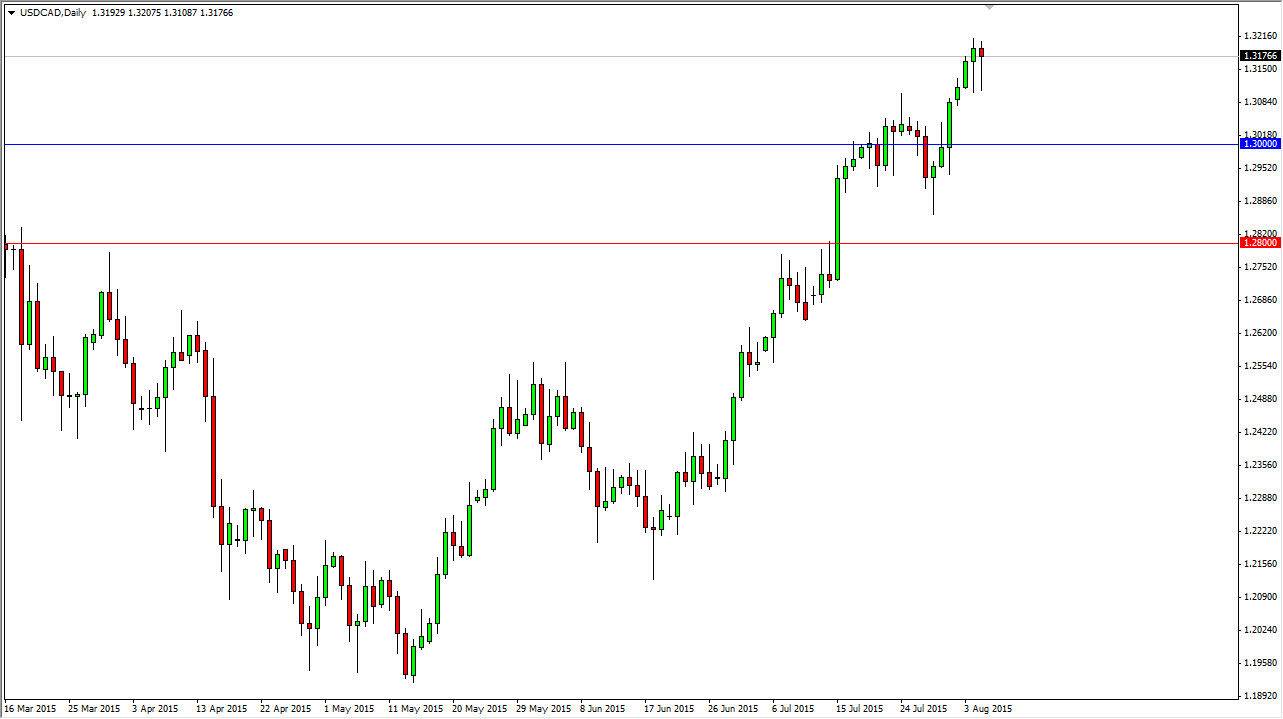

The USD/CAD pair initially fell during the course of the session on Wednesday, but found enough support near the 1.31 level to turn things back around for a hammer again. Because of this, it looks as if the buyers are most certainly getting aggressive in this pair, and that of course makes sense as the Bank of Canada has recently had a surprise interest-rate cut, while the Federal Reserve looks to raise interest rates sometime later this year. In other words, the interest-rate differential is shrinking.

Adding more pressure on the Canadian dollar is the fact that the oil markets simply are not very strong right now. Oil has a massive effect on the value the Canadian dollar over the longer term, and as a result it makes sense that as the value of oil falls, so does the value of the Canadian currency.

More pain in the petroleum markets

I believe that the oil markets continue to fall, and I think this currency pair is just simply an excellent demonstration of what’s about to happen. I recognize that petroleum has been sold off rather drastically over the last several months, but at the end of the day there’s really nothing to keep it from falling down to the $42 level in the WTI Crude Oil market. With this, we have further downside, and that of course will weigh upon the Canadian dollar. On top of that, there is a bit of a safety aspect to owning the US dollar, and of course commodities in general continue to suffer. Commodity currencies right now look very soft, and while the Canadians have the advantage of being in North America, the truth of the matter is that it’s little consolation when your main export is falling in value. With this, I believe that the market will be one that you can buy again and again every time it dips going forward. At this point in time I expect to see the market test the 1.33 level fairly soon. I also believe that the 1.28 level is the absolute “floor” in this market.