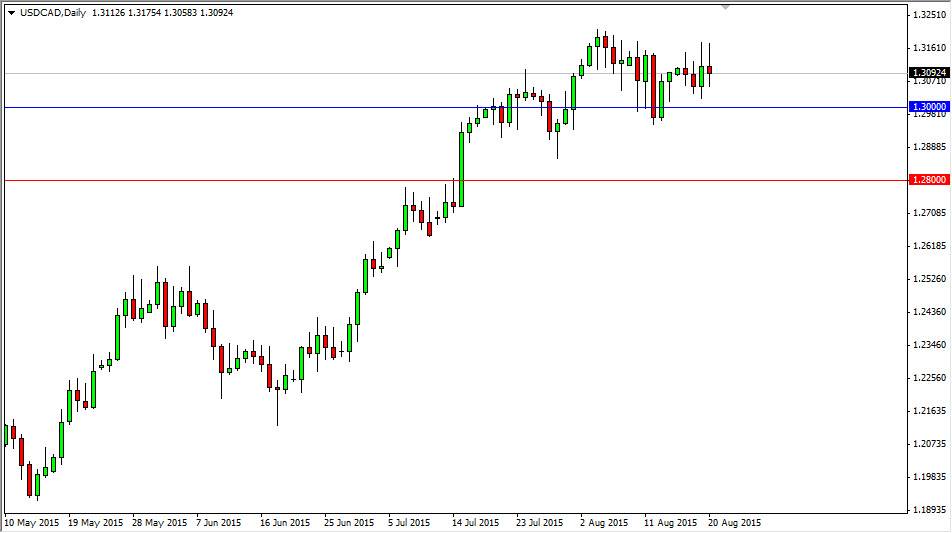

The USD/CAD pair initially tried to rally during the course of the day on Thursday, but found enough resistance of the 1.32 level to turn things back around and form a massive shooting star. This happened on Wednesday as well, so having said that it looks as if the market is starting to soften up a little bit. Nonetheless, I am not looking to sell this pair even though having two candles that look like this in a row is a very negative sign. Ultimately, I see a massive amount of support below, starting at the 1.30 handle. That is the beginning of a massive zone all the way down to the 1.28 level that should offer quite a bit of buying pressure. Any type of supportive candle in that region should be a significant buying opportunity.

Oil

Oil markets of course move the Canadian dollar as most of you will know, as there is so much exported from that country. With this, if we see the Canadian dollar rise in value as oil does, and falls as oil does as well. With that, the market could tip a little bit from here but I look at it as value in the US dollar going forward. On the other hand, if we break above the 1.32 level, that would be a very positive sign and should send this market looking much higher. At that point in time, I would anticipate that this market would head to the 1.35 handle, but this pair does tend to grind more than take off in one direction for any real length of time.

With this, expect a lot of volatility but I still favor the upside and have no interest whatsoever in shorting at least until we get well below the 1.2750 level, something that doesn’t look very likely at this point in time. Oil is starting to rally a little bit, but at this point in time it looks to be a relief rally at best.