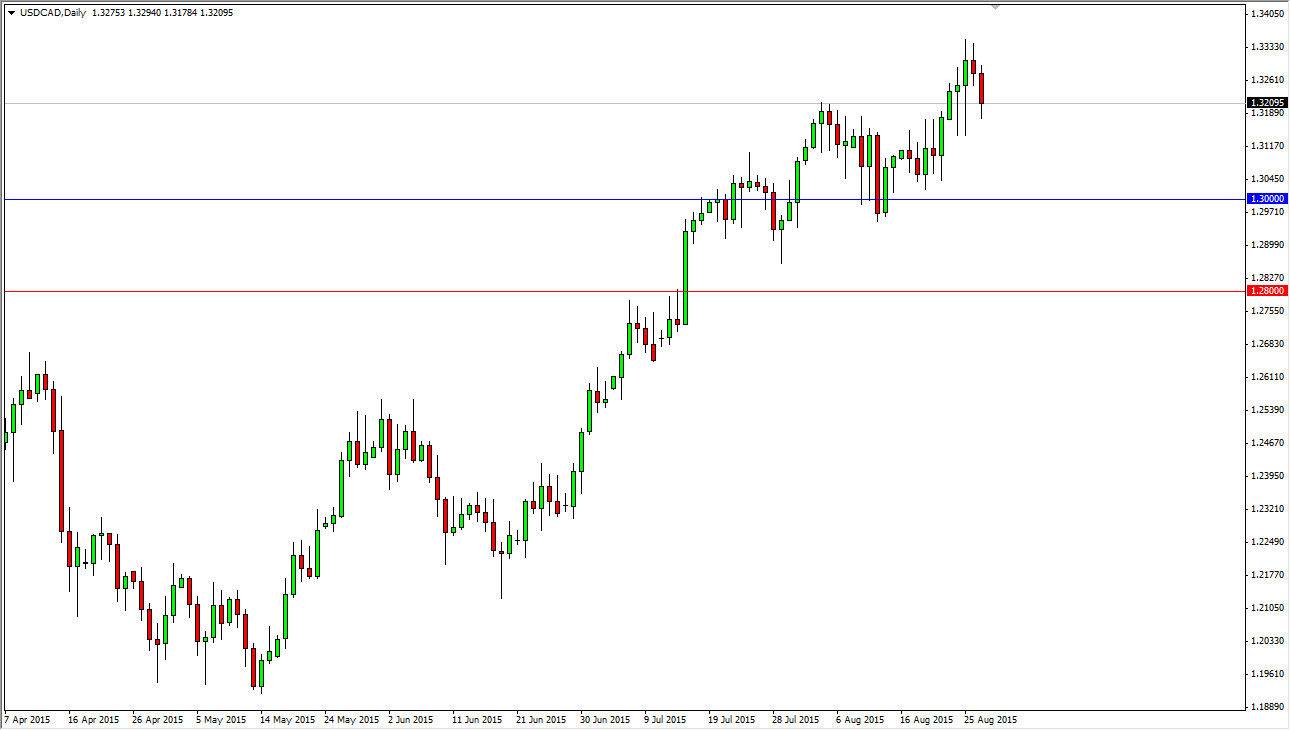

The USD/CAD pair fell during the session on Thursday, dropping below the 1.32 level at one point. This is an area that has been offered a bit of support though, so it’s very likely that this market will bounce from here. Even if it doesn’t, I see a significant amount of support all the way down to at least the 1.30 handle, so I am not looking to sell this market. That being the case, I’d simply sitting on the sidelines and waiting for a supportive candle in order to get involved yet again.

Keep in mind that the crude oil markets have been horribly negative, and as a result it makes sense that the market will continue to favor the US dollar of the Canadian dollar as the Canadian dollar is so heavily influenced by that particular commodity.

Looking for support, buying pullbacks

Looking at the market, you can see that there is a large amount of noise just above the 1.30 level, so having said that it makes sense that the buyers will return every time we drop down there. On top of that, I have a red line on this chart all the way down at the 1.28 level. With that being the case, the market looks as if it is more or less a support zone in my opinion. I believe as long as we can stay above the 1.28 level, we are still in an uptrend as far as all things are showing.

I believe that we go to the 1.35 level first, and then eventually higher than that. Perhaps we will get to the 1.40 level but it will certainly be influenced by what’s going on in the petroleum markets overall. I believe that sooner or later the buyers will return every time we dip, and the oil markets are going to continue to struggle overall as supply is far too strong. Also, you have to keep in mind that the GDP out of America came out much higher than anticipated during the session on Thursday, so we should eventually see strength in the dollar again.