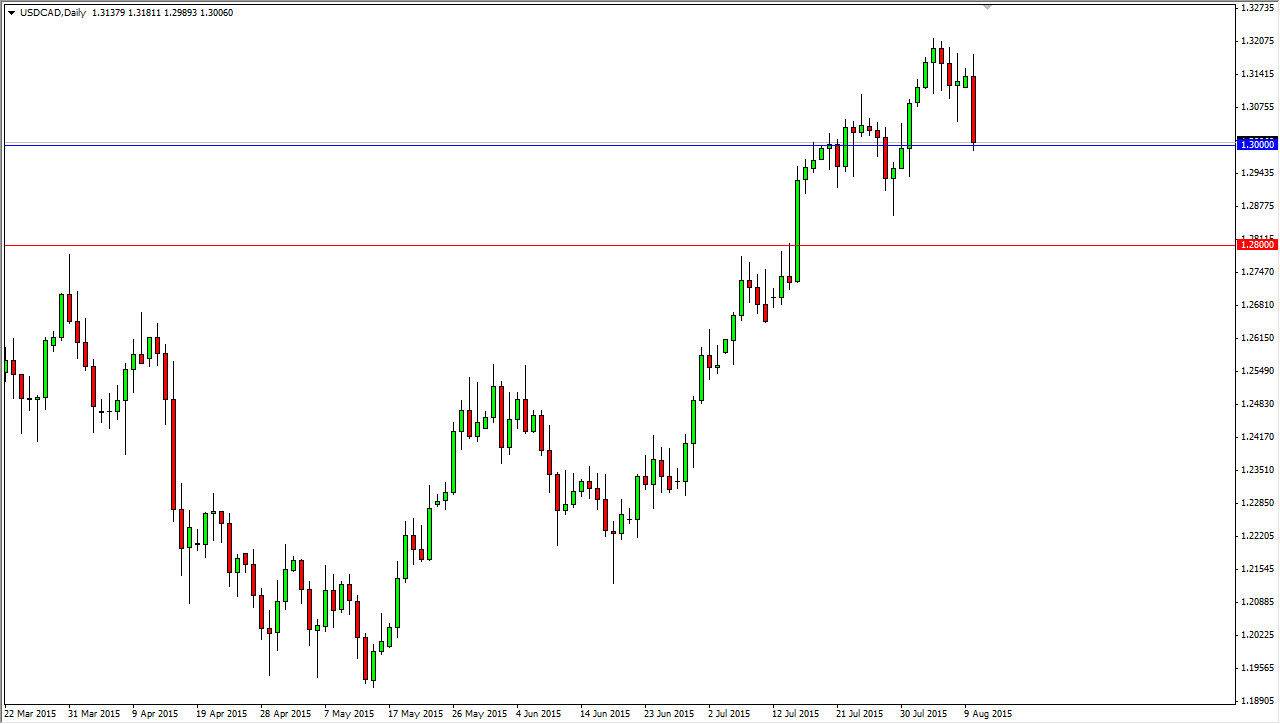

The USD/CAD pair initially tried to rally during the session on Monday, but as you can see turned back around to reach down towards the 1.30 handle. With this, it shows that the trend may be getting a little bit “long in the tooth”, but at this point in time I don’t see any reason to start selling. After all, I believe that the support runs all the way down to the 1.28 handle, so it is not until we get below there that I would be comfortable selling. There are simply far too many things working against the value of the Canadian dollar at the moment to start buying it.

I do recognize that we are at a massive spot when it comes to the longer-term chart. After all, the 1.30 level was where the financial crisis sent this pair several times, but could not break above it. With this, I would anticipate that there is a massive amount of resistance. However, we broke above that level recently, so this does in fact suggests that some of that resistance has been broken away.

Oil markets

Oil markets simply are not doing enough to keep the Canadian dollar strong. Granted, they did have a fairly strong session on Monday, but at the end of the day we are still quite a way from turning this trend around. While I do like buying crude oil for the long-term, I recognize that if you do anything along the lines of leverage at this point in time, you are simply playing with fire. This is most certainly true when it comes to currencies, so at this point in time I do not have any interest whatsoever in selling this pair.

If we broke down below the 1.28 level, I believe that this market would then break down significantly, but I would only start selling if it is incongruence with a spike in the price of crude oil. This will be a “market wide move”, so something like that would be easy to trade. The meantime, I just don’t see the catalyst. I am waiting for a supportive candle in order to start buying.