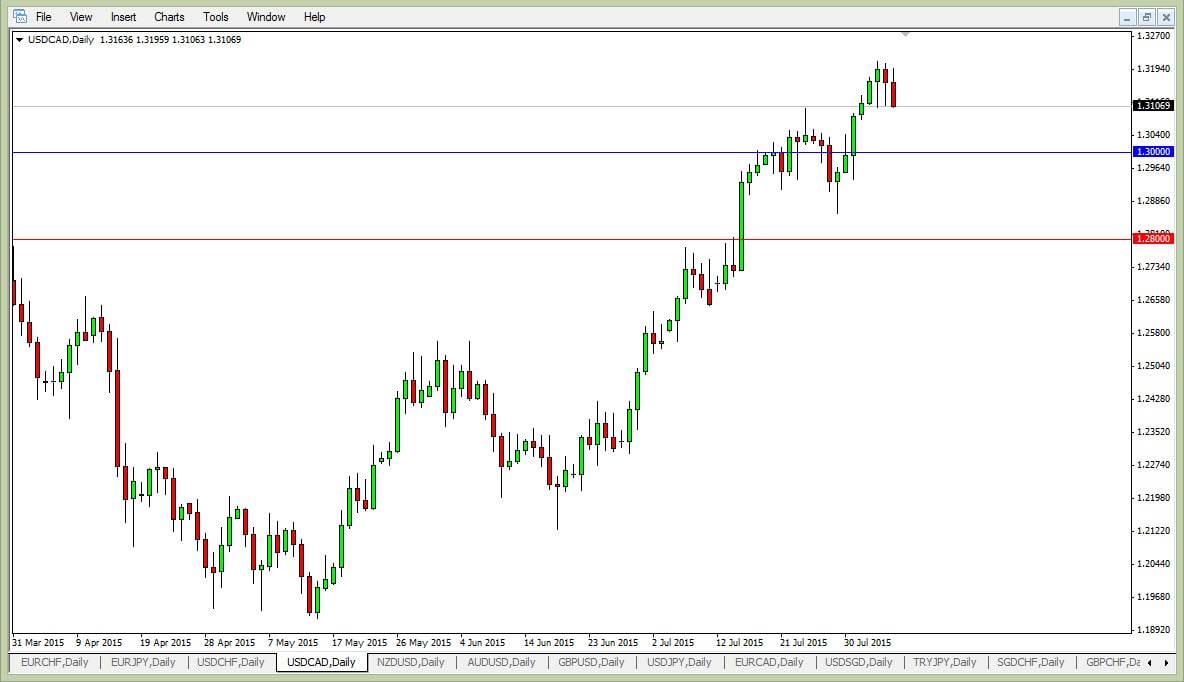

The USD/CAD pair fell during the course of the session on Thursday, pulling back a bit from recent highs. However, I find this to be the one currency pair to pay attention to today more than any other market, simply because we have the Nonfarm Payroll Numbers coming out of the United States, while we have the Unemployment Numbers coming out of Canada. In other words, this is a bit of a “perfect storm” for extreme moves.

This pair has been strong for quite some time, and the fact that we broke above the 1.30 level isn’t lost on me. After all, this was the area that kept the market under control during the financial crisis. We slammed in this area several times, and cannot break above it. Now that we have, I think that’s a huge deal. I think this pair goes higher over the longer term, and as a result I don’t have any interest in selling this pair under any circumstances at the moment.

A couple of scenarios

If we pullback from here, I think there is a massive amount of support between the 1.30 level and the 1.28 level below it. I think that there will be supportive action in that area that can be bought, and I would look at it as “value” in the US dollar. On top of that, if we get bad Canadian employment numbers that could just be more of a catalyst to go higher. Oil markets are certainly not doing anything to help the Canadian dollar either, and they look vulnerable to further weakness. In other words, I think that we pullback you have to jump on top of this and take advantage of the value that will be offered. Any pullback or selloff in this currency pair will be short-term in nature at best, and will be thought of as a perfect buying opportunity in the future. At this point in time, I just don’t have a scenario in which a willing to sell.