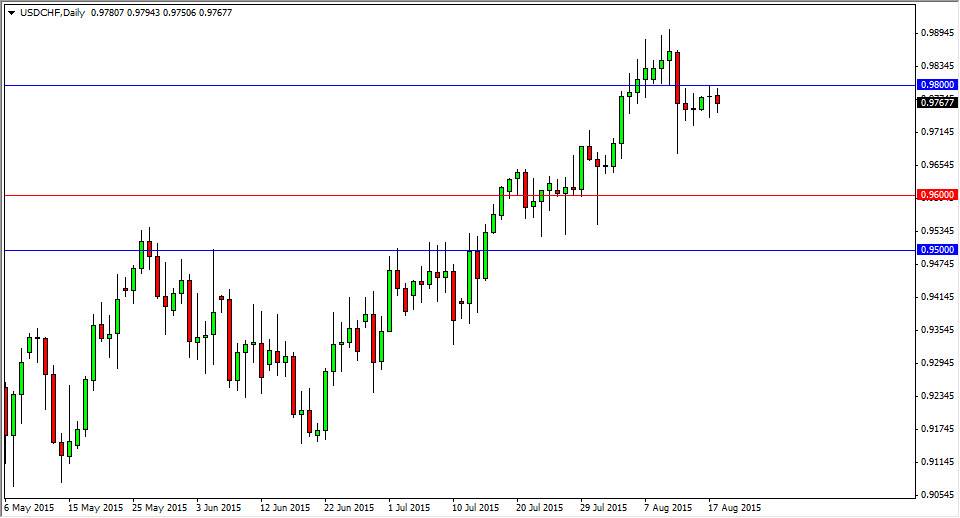

The USD/CHF pair went back and forth during the course of the session on Tuesday, bringing up against the 0.98 level. With this, the market looks as if it is going to continue to find quite a bit of pressure at the 0.98 level, as it is a large, round, psychologically significant number, and of course an area that has attracted a lot of attention in the past. However, we have broken above it recently, and as a result I feel that we will continue to see this bullishness going forward.

With that in mind, I think the only thing you can do is buy this pair. On top of that, there are some other things going on in the background that you should be aware of. For example, the Swiss National Bank has recently released financial statements that suggests they have been shorting the Swiss franc against other currencies. While the US dollar isn’t necessarily going to be the first one that they work against, the reality is that shorting the Swiss franc has a “knock on effect” around the world, and of course includes the value against the US dollar.

North America versus Europe

If you keep in mind that the US dollar is representative of the North American economy, and of course the Swiss franc represent a significant portion of Europe, as while the Swiss have their own economy and currency, the truth of the matter is that the Swiss are highly leveraged to what goes on in the European Union, and with this it appears that they will continue to suffer. Ultimately, the US dollar is considered a safety currency, and on top of that it is representative of an economy that’s growing, something you at is lacking in most other places, at least of any significance. With this, I think that this pair continues to not only go higher, but will eventually test and break above the parity level given enough time. This is in exactly a barnburner of a currency pair though, so do not expect massive moves higher in short-term moves.