USD/CHF Signal Update

Last Thursday’s signals expired without being triggered as none of the key levels were hit that day.

Today’s USD/CHF Signals

Risk 0.75% per trade.

Trades may only be entered between 8am and 5pm London time today.

Long Trade 1

Long entry after bullish price action on the H1 time frame following the next touch of 0.9717.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Long Trade 2

Long entry after bullish price action on the H1 time frame following the next touch of the bullish trend line currently sitting at around 0.9640.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 1

Short entry after bearish price action on the H1 time frame following the next touch of 0.9900.

Put the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

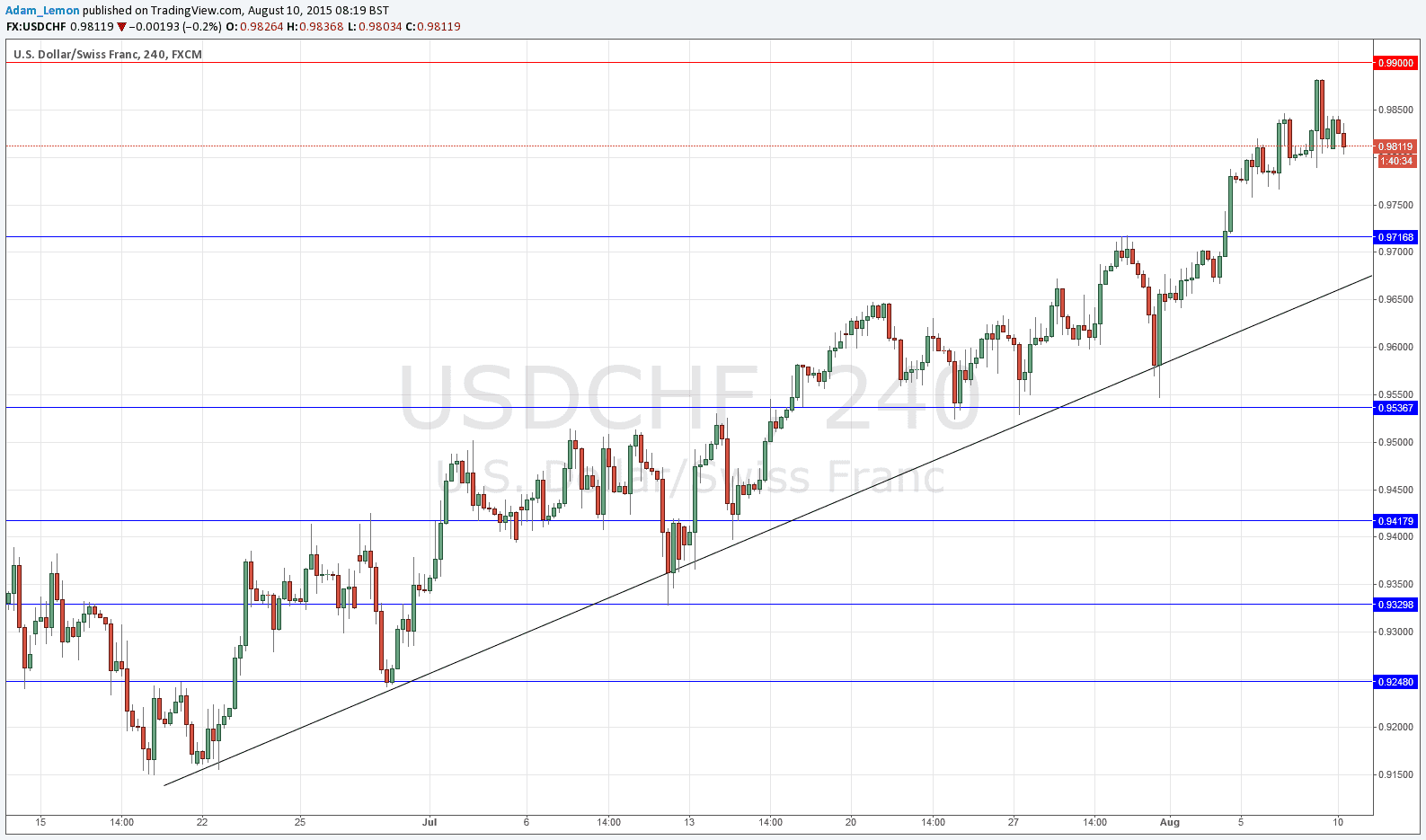

USD/CHF Analysis

During Friday’s London session this pair made a new multi-month high, exceeding my anticipated resistance level at 0.9860 by 20 pips or so before falling. If you look at the chart below, you see a sustained upwards move in this pair that has been supported by a fairly steep bullish trend line for almost two months. However the trend is beginning to look somewhat over-extended, as the action has got more volatile and bearish over the past few days, and the price has moved to a location quite far above the trend line. This suggests that the next step is at least some kind of retracement and a pull back to the first support level could be a great buying opportunity. On the other hand, should the price make a new high and bounce bearishly off the round number at 0.9900, this could be an opportunity to get short before any retracement or even a possible trend change got going.

In any case, neither of these important possibilities are likely to happen today, as it will probably be a very quiet session, at least until London closes.

There is nothing due today regarding the CHF. Concerning the USD, FOMC Member Lockheart will be speaking at 5:25pm London time.