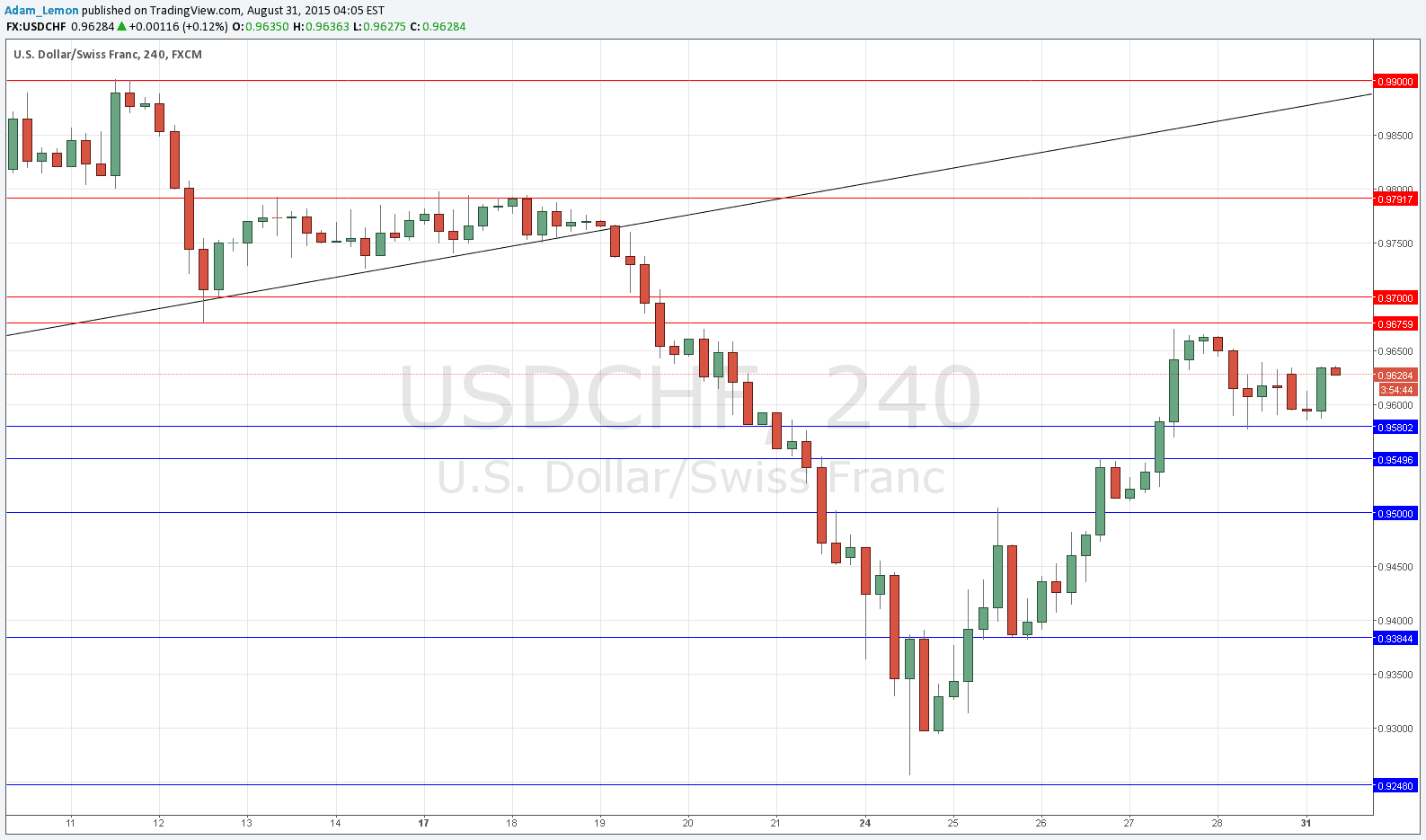

USD/CHF Signal Update

Last Thursday’s signals expired without being triggered as there was no bearish price action at 0.9580.

Today’s USD/CHF Signals

Risk 0.75% per trade.

Trades must be made only between 1pm and 5pm London time today.

Long Trade 1

Long entry after bullish price action on the H1 time frame following a touch of 0.9580.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 30 pips in profit.

Take off 50% of the position as profit when the trade is 30 pips in profit and leave the remainder of the position to run.

Long Trade 2

Long entry after bullish price action on the H1 time frame following a touch of 0.9550.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 30 pips in profit.

Take off 50% of the position as profit when the trade is 30 pips in profit and leave the remainder of the position to run.

Long Trade 3

Long entry after bullish price action on the H1 time frame following a touch of 0.9500.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 30 pips in profit.

Take off 50% of the position as profit when the trade is 30 pips in profit and leave the remainder of the position to run.

Short Trade 1

Short entry after bearish price action on the H1 time frame following an entry into the zone between 0.9675 and 0.9700.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 30 pips in profit.

Take off 50% of the position as profit when the trade is 30 pips in profit and leave the remainder of the position to run.

USD/CHF Analysis

The orderly upwards move in this pair continued last Thursday, then on Friday there was a pull-back which confirmed that the former resistance at 0.9580 had begun to act as support. Therefore it now looks like we have support at 0.9580 and also at 0.9550, with the resistance zone overhead intact beginning at 0.9675.

It looks like the best short-term opportunity will probably be a long off 0.9580.

There is nothing due concerning either the CHF or the USD today. It is a public holiday in the U.K. so liquidity will probably be very light until the New York open later.