USD/CHF Signal Update

Yesterday’s signals expired without being triggered as there was no bearish price action at 0.9717.

Today’s USD/CHF Signals

Risk 0.75% per trade.

Trades may only be taken between 8am and 5pm London time today.

Long Trade 1

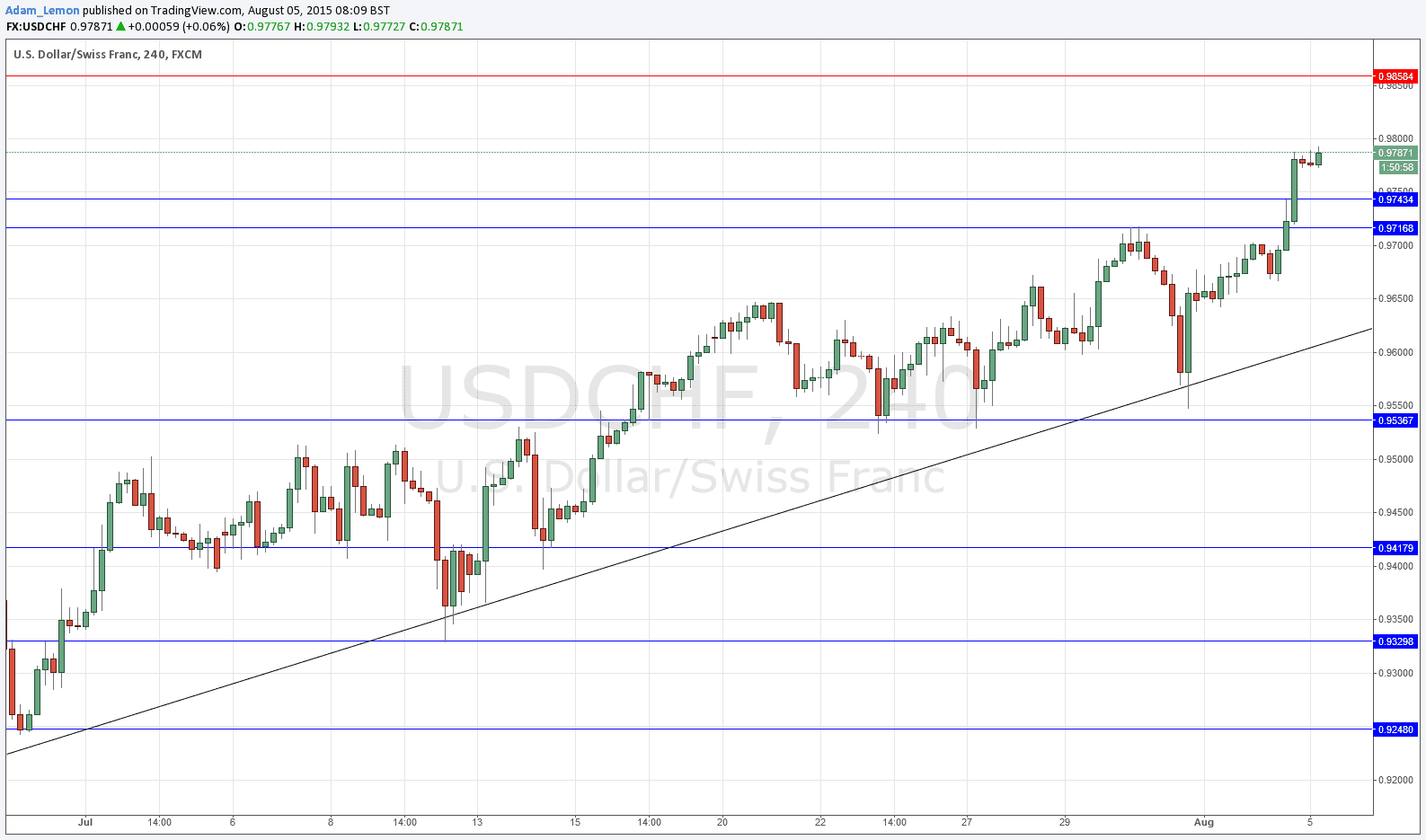

Long entry after bullish price action on the H1 time frame following the next touch of 0.9743.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Long Trade 2

Long entry after bullish price action on the H1 time frame following the next touch of 0.9717.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Long Trade 3

Long entry after bullish price action on the H1 time frame following the next touch of the bullish trend line currently sitting at around 0.9717.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 1

Short entry after bearish price action on the H1 time frame following the next touch of 0.9860.

Put the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

USD/CHF Analysis

It was a quiet session yesterday until the surprise comments from the Fed arrived during the late New York session and sent the USD strongly higher. The CHF, along with the CAD, has been acting as the weakest currency in recent days and so yesterday’s move made its major impact here, sending the pair to a new multi-month high. The price has held off overnight and a further move up would not be surprising. If the USD data later is positive, it could really take off. There are a couple of probable support levels not far below if we break down past the Asian session low at which to look for long trades.

There is nothing due today regarding the CHF. Concerning the USD, there will be a release of ADP Non-Farm Employment Change data at 1:15pm, followed by the Trade Balance at 1:30pm and ISM Non-Manufacturing PMI at 3pm.