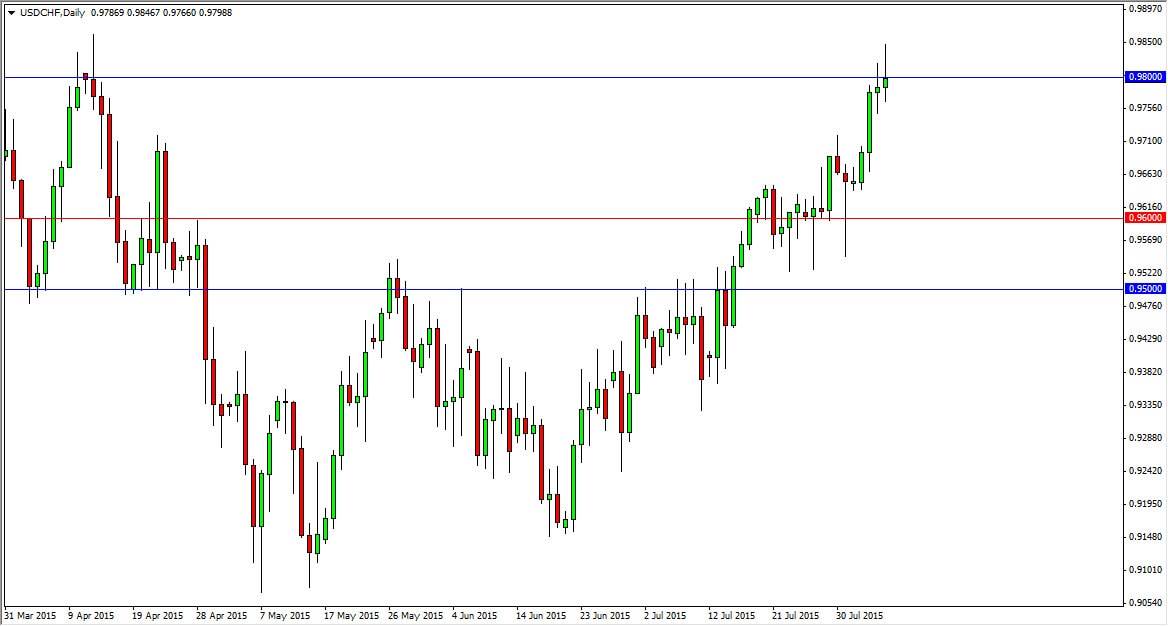

The USD/CHF pair broke above the 0.98 level during the session on Thursday, but as you can see we gave back quite a bit of gains in order to form a bit of a shooting star. With this, I think that the market continues to struggle in this area but you have to keep in mind that the Nonfarm Payroll Numbers come out during the session today. Because of that, a lot of profit taking probably would’ve been going on during the session as the 0.98 level is not only a large, round, psychologically significant number, but also served as resistance previously. With that, it looks as if the markets will probably pull back from here.

That pullback to me represents value in the US dollar, and I will be looking for supportive candles below in order to take advantage of that value. On the other hand, we can break above the top of the shooting star, and if we break above the top of the shooting star, I feel that the market will then reach towards the parity level. Ultimately, that is my longer-term target anyway.

Swiss National Bank

Keep in mind that this National Bank has been working against the value the Swiss franc in general, so it does not surprise me that this pair goes higher. Granted, that generally is done in the EUR/CHF pair, but it does have a bit of a knock on effect over here. On top of that, you have the US dollar which of course is favored by currency traders around the world at the moment anyway. Keep in mind that the Swiss unfortunately have 85% of their exports sends to the European Union, and as a result they are a bit tied to the fortunes of that region. On the other hand, you have the North American currencies which are essentially sheltered from a lot of that, and of course it makes sense that the US dollar would be favored in this particular circumstance. I have no interest in selling.